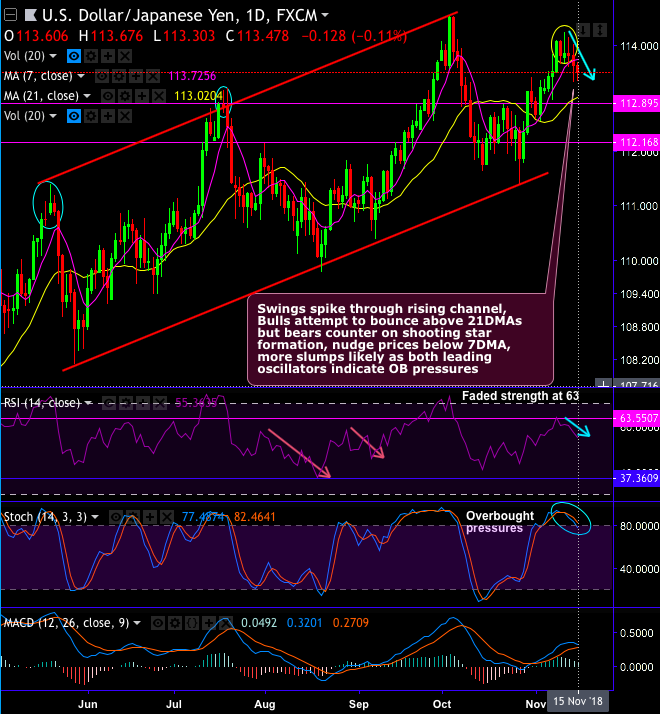

- USDJPY has tested support at channel baseline, ever since then the minor price trend has been spiking through rising channel, but for now, bears are now attempting to counter on shooting star formation at 113.834 levels, consequently, nudge prices below 7DMA, further slumps seem to be most likely as both leading oscillators (RSI & stochastic curves) indicate overbought pressures.

- Well, we see stiff resistance at 113.7219 (i.e. 7DMAs) and strong supports at 113.012 levels (i.e. around 21DMAs) (on daily charts).

- On major trend, bulls seem to be exhausted at 61.8% Fibonacci levels from the lows of June 2016, (refer monthly plotting), the trend on this timeframe, is stuck in tight range.

- On the flipside, the major trend has been in consolidation phase, more rallies likely upto 61.8% fibos on bullish momentum, trend indicators indecisive, we see bullish invalidation on retrace below.

Trade tips: Contemplating above technical rationale, it is wise to bid tunnel spreads with upper strikes at 113.7219 and at 113.012 levels asduring the overnight session, the US retail sales numbers data announcement and Fed chair Powell speech are due. The strategy is likely to fetch leveraged yields as long as the underlying spot FX keeps dipping but remains well above lower strikes on the expiration.

Currency Strength Index: FxWirePro's hourly USD spot index was at -62 (which is bearish), while hourly JPY spot index was at 12 (neutral) at 12:49 GMT.

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex