The BoJ maintains status quo in its monetary policy, focusing to soothing 10Y Treasury bond yield, the benchmark for long-term borrowing costs, at around zero pct and keep the overnight interest rate around -0.1%. and asset purchases program at ¥80 trillion.

The goal is to correct the excessively flat yield curve caused by its negative interest rate policy that took effect in February.

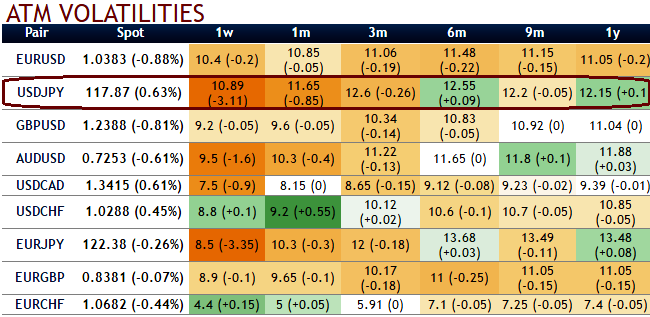

The recent fast spot upside lifted the 6m implied volatility to return to its highest level since 2013, which in itself is a reason to suspect mean-reversion will occur. It turns out that the relationship between spot and implied volatility suggests with more insistence that USDJPY.

Mounting global inflation, lifting US long yields, and persistent policy uncertainty have elected the dollar as the winner. The risk is for risk sentiment to change, thus the resilience of the risk mood bears watching because it is the key to the yen's continued weakness. Uncertainty is, however, unlikely to lift FX volatility further until the environment turns risk-off. Trump’s victory has so far not been conducive to such a shift.

On reduced central bank activity BoJ maintained unchanged monetary policy, which has committed to an overshooting commitment of achieving the 2% price stability target. The bank has shifted its primary tool for easing from quantity to the interest rate and, as the target is not a rigidly timed goal, the central bank is unlikely to implement additional easing. One of our key market themes was that the BoJ’s peg of long-term yields will transfer the suppressed rate volatility to the currency and equities.

You could probably understand the shrinking vols from the above IV nutshell and both RVs and IVs have constantly been making lower lows, this would demonstrate much about underlying USDJPY sentiments

Unlike NKY volatility, USDJPY volatility already has benefited from the volatility boost via an impressive topside acceleration. But now that US rates have picked up post the US election and following the Fed’s hike and adjustment higher of the dot plot, the yen depreciation should be more gradual. The market is due to take a breather which will dampen USDJPY realized volatility.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data