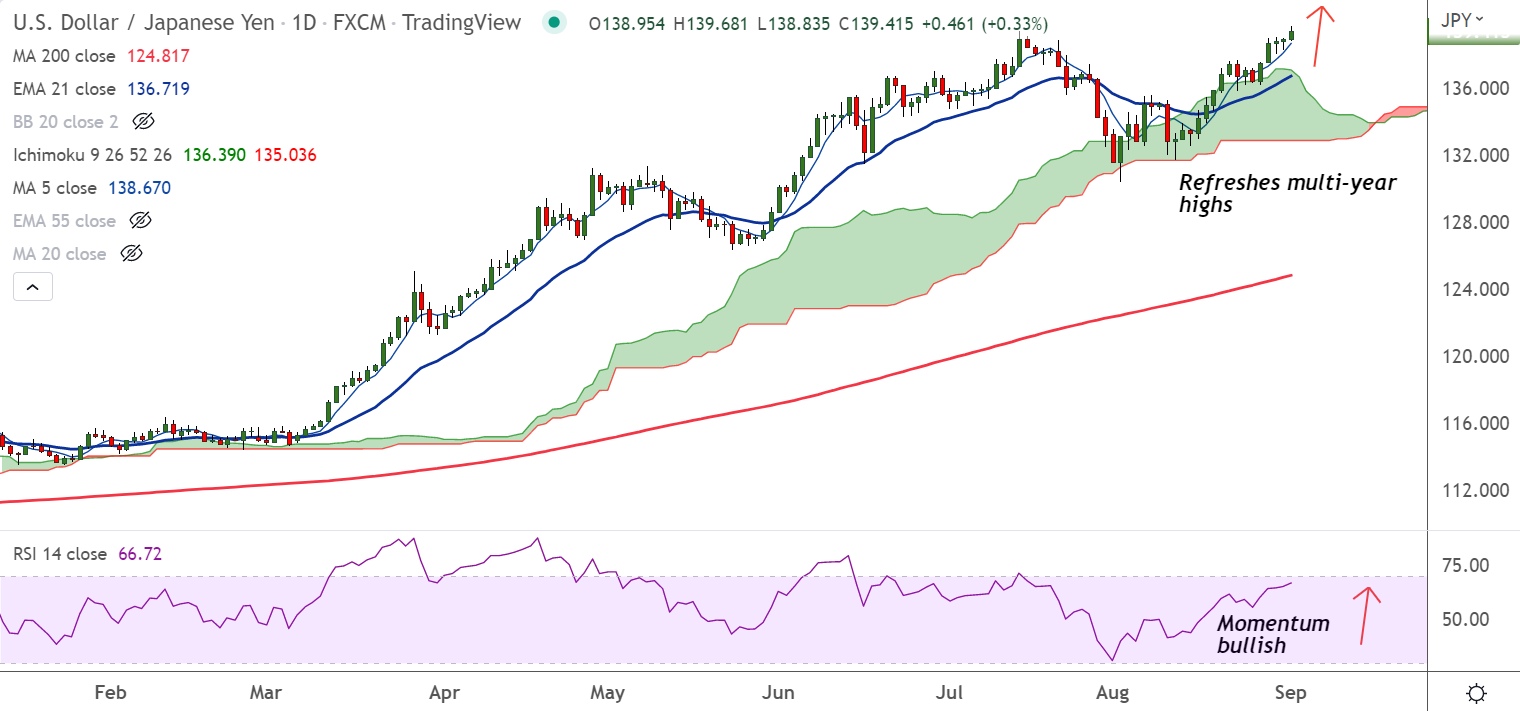

Chart - Courtesy Trading View

USD/JPY was trading 0.39% higher on the day at 139.50, technicals show bullish bias remains intact.

The pair has hit new 24-year high at 139.68, levels unseen since October 1998 before paring some gains.

Hawkish Fed bets along with risk-negative headlines from China, Taiwan add strength to the upside momentum.

Dollar bulls ignore softer US data which showed the ADP Employment Change grew by 132K versus 288K expected and 270K prior.

Looking forward, focus on the US ISM Manufacturing PMI for August, expected 52.8 versus 52.0 prior, ahead of Friday’s US Nonfarm Payrolls (NFP).

Major Support Levels:

S1: 138.66 (5-DMA)

S2: 136.72 (21-EMA)

Major Resistance Levels:

R1: 140.08 (Upper BB)

R2: 141

Summary: USD/JPY trades with a strong bullish bias. The major is on track to test 140 mark.