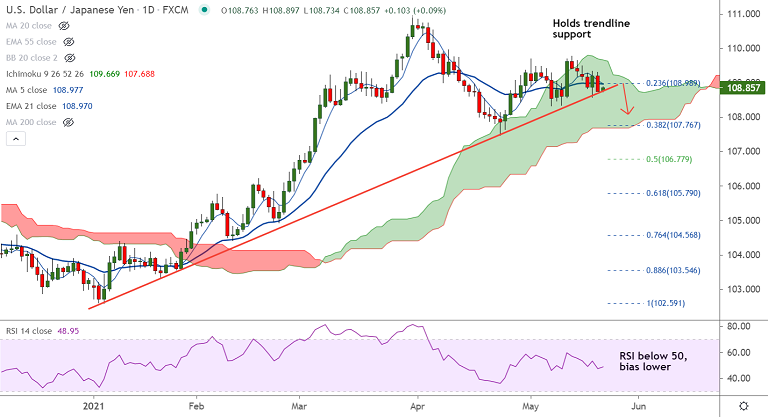

USD/JPY chart - Trading View

Spot Analysis:

USD/JPY was trading 0.08% higher on the day at 108.84 at around 04:20 GMT.

Previous Session's High/ Low: 109.30/ 108.74

Previous Week's High/ Low: 109.78/ 108.34

Fundamental Overview:

The Japanese Consumer Price dropped by 0.4% YoY in April. Price fell to 0.4% MoM, as the pandemic weighs on household spending.

Concerns of coronavirus infections and the warning from Bank of Japan Governor Haruhiko Kuroda keep the yen depressed and limit downside.

Traders shrug off inflationary fear and expectations of sooner Fed tightening. Fed officials restated that the economy is far from full recovery and downplayed inflation pressures to only be transitory.

US Treasury yields rose mildly on Friday, with the benchmark 10-year reaching 1.63%. DXY has slipped below 90 and was trading at 89.75 at around 04:50 GMT.

Technical Analysis:

USD/JPY trades with a bearish bias. Erases early gains and slips lower from session highs at 108.89.

Momentum studies are bearish, Stochs and RSI are sharply lower and RSI is below 50.

Price action has slipped below 200H MA and GMMA indicator shows bearish bias on the intraday charts.

Summary: USD/JPY pivotal at trendline support. Focus now on the release of US PMI data Existing Home Sales data to gauge the market sentiment. Break below trendline support will see dip till 38.2% Fib at 107.76.