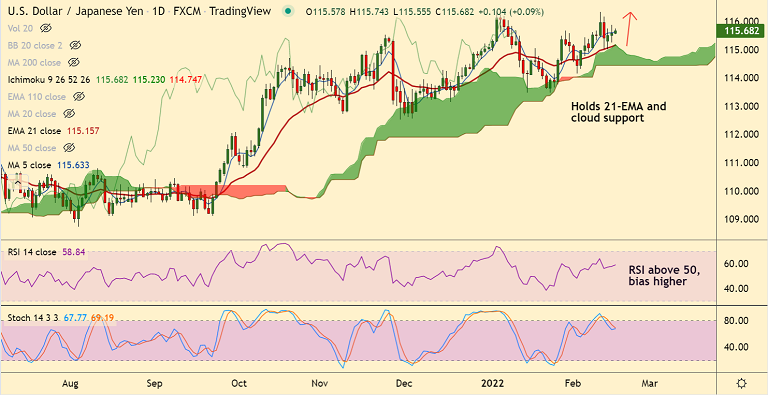

Chart - Courtesy Trading View

USD/JPY was trading 0.18% higher on the day at 115.78 at around 08:40 GMT. The pair is extending gains for the 3rd straight session, outlook is bullish.

Easing geopolitical tensions have decreased demand for safe-haven assets, Japanese yen under pressure.

US data released overnight was mixed. US Producer Price Index (PPI) rose past 9.1% YoY expectations to 9.7%, versus upwardly revised 9.8% prior, in January. Core PPI, rallied to 8.3% versus 7.9% market consensus.

Additionally, NY Empire State Manufacturing Index eased below 12.15 forecasts to 3.1, compared to -0.7 previous readouts.

Technical indicators are bullish. Markets eye US Fed meeting minutes and US retail sales for further direction.

January Retail Sales from the US is expected to reverse -1.9% previous contraction with +2.0% growth.

Also in focus will be the Federal Open Market Committee (FOMC) Minutes as traders jostle over 0.50% rate-hike clues.