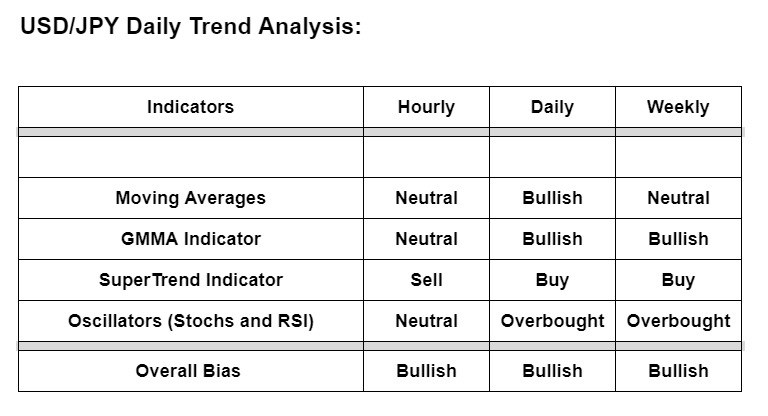

USD/JPY daily trend analysis shows the pair trades with a major bullish bias.

Focus on key US Consumer Price Index (CPI) for February due 12:30 GMT later in the NY session.

US Consumer Price Index (CPI) for February is expected to rise to 1.7% YoY versus 1.4% prior.

Caution prevails ahead of US covid aid package announcements. Upbeat data could fuel further gains in the pair.

Markets expect US president Joe Biden to sign $1.9tn of fiscal relief into law this week. Any disappointment could weigh down the pair.

Major Support Levels:

S1: 108.48 (5-DMA)

S2: 108.13 (76.4% Fib)

S3: 107.57 (200H MA)

Major Resistance Levels:

R1: 108.99 (200 W MA)

R2: 109.85 (June 2020 high)

R3: 110 (Psychological level)

Summary: Technical bias is bullish. Upbeat data could add to the upside momentum. 200W MA at 108.99 is major resistance. The pair failed to close above in the previous week. Decisive break above required for further upside.