This week, major central banks (BoJ and BoC) are centre of attraction as they are scheduled for their monetary policies, on Wednesday, and there is a higher-than-usual degree of uncertainty. BoJ is most likely to maintain negative rates on hold. The BoJ will be in focus for now and we expect them to follow in the footsteps of other DM central banks and turn more dovish, which should still be conducive of selling USDJPY downside.

USDJPY fell from 112.166 to the recent lows of 111.650 levels, the defensive yen has been the top performer of the day. We feel quite fortunate to be exiting in the black having owned USDJPY through a deep and sometimes volatile correction in US stocks.

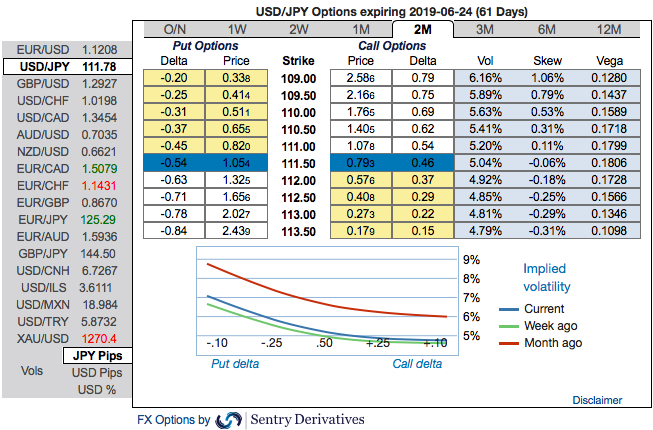

USDJPY OTC update and options strategy as follows:

Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 109.00 levels so that OTM instruments would expire in-the-money. These positively skewed IVs indicate hedgers’ interests in OTM put strikes, overall, put holders are on upper hand.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, a couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 111.877 levels, we advocate buying a 2M/2w 112.369/109.00 put spread ahead of Fed and BoJ monetary policies (vols 5.12 vs 4.74 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 76 levels (which is bullish), while hourly USD spot index was at 60 (bullish) while articulating at (09:33 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis