Revising down USDJPY forecasts: Amid short-medium term spikes, the downside risk to USDJPY heightens due to policy constraints. New target at 103 by Q3’2017.

Background of recent JPY development and outlook: USDJPY to be weighed but the pace of decline to be modest.

Macroeconomic environment in the US:

The several indicators have softened lately, including a large downside surprise in March core CPI.

But labor market remains in solid shape, and we expect growth to rebound following a weak first quarter.

FOMC to proceed with tightening, but doves may see the reason for caution.

We expect weak 1Q real GDP growth (0.6% SAAR) and unexciting ECI (0.6% SAQR).

Macroeconomic environment in Japan:

Real exports fell in March but increased solidly in 1Q.

April flash PMI suggests that manufacturing activity remains steady.

In April, large manufacturers business sentiment hit its highest level since 2007, but the outlook remains cautious.

Busy week ahead: BoJ meeting with Outlook report (Thu) and major March data (Fri).

Option Trade Recommendations:

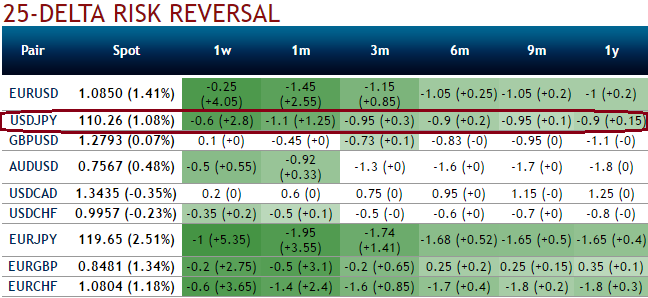

For laggards, since the hedging sentiment is shifting for bullish risks but the above mentioned fundamental driving forces likely to cause the major trend on either direction, we advocate buying USDJPY 1Y ATM straddles.

Although we see the bullish shift in hedging setup the aggregate risk reversal numbers are still in negative trajectories, contemplating massive shrink in IVs we add on long a 6-week USDJPY in the proportion of 1x2x1 put fly (strikes 105.534 x 110.25 x 115).

Aggressive bears can bid 3-month risk reversals while eyeing on short term IVs, and initiate longs in 1x1.5 105-101 USDJPY ratio put spread.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation