- USD/JPY fails to break major trendline resistance at 112.90, edges lower for 3rd successive session.

- The major is trading range bound on the day, with day's high at 111.80 and low at 111.50.

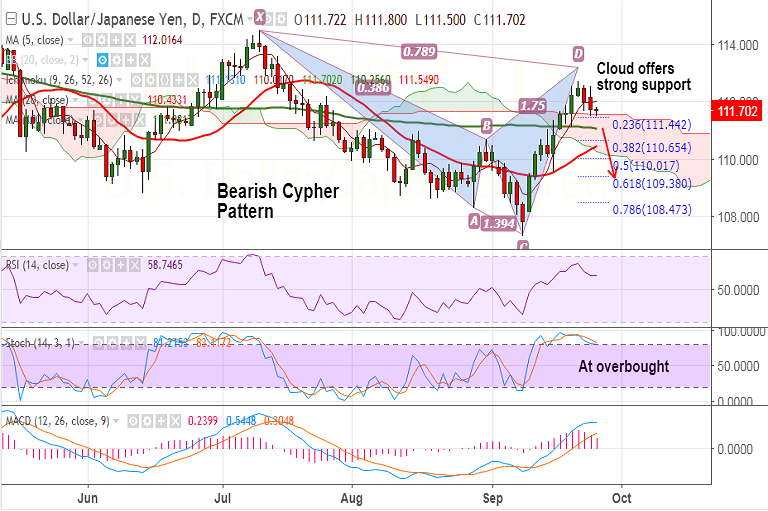

- We evidence a 'Bearish Cypher' pattern on daily charts which adds scope for downside.

- Daily cloud is offering strong support at 110.55 levels, we see weakness on break below.

- Dovish comments from Fed Evans and North Korea news led risk-aversion weighing on the pair.

- Fed Chair Yellen’s speech due later today will be closely watched for further direction.

Support levels - 111.55 (cloud top), 111.08 (100-DMA), 110.65 (38.2% Fib retracement of 107.318 to 112.716 rally)

Resistance levels - 112.04 (5-DMA), 112.71 (Sept 21 high), 113

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 86.5202(Bullish), while Hourly JPY Spot Index was at 155.629 (Bullish) at 1040 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest