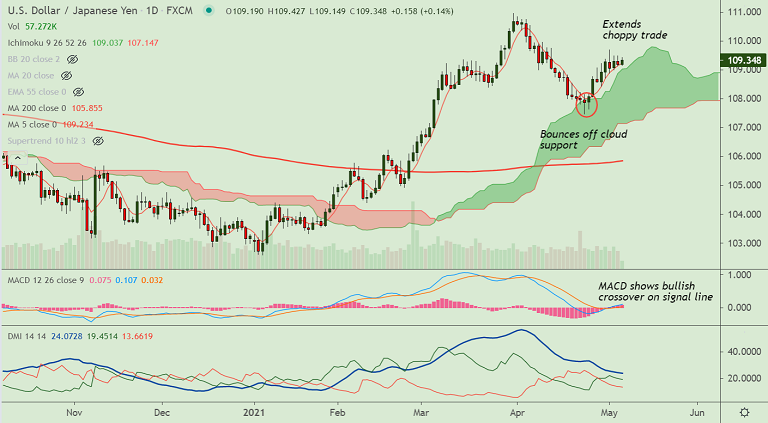

USD/JPY chart - Trading View

Spot Analysis:

USD/JPY was trading 0.13% higher on the day at 109.32 at around 05:35 GMT.

Previous Day's High/Low: 109.48/ 109.14

Previous Session's High/Low: 109.37/ 107.64

Fundamental Overview:

A fresh wave of risk-aversion amid deteriorating Sino-Australia trade relations keeps safe-haven dollar bids.

Pre-NFP trading lull may continue to hinder the pair’s performance ahead of Friday’s key US jobs report.

Fed policymakers rejected fears that the latest inflation run-up may trigger monetary policy normalization.

A weaker US ADP unemployment and ISM Services PMI data along with dovish expectations from the Fed keep upside in check.

Looking forward on the data front, U.S. Q1 Nonfarm Productivity and Labor Costs and Initial Jobless Claims for the week ended April 30 will be in focus.

Technical Analysis:

- GMMA indicator supports gains with major and minor trend being bullish on the daily charts

- Price action is consolidating above 200W MA with a Doji formation on the weekly candle till date

- The pair is trading above daily cloud which had proved strong support during the pullback

- Stochs and RSI are sharply higher and support a bullish momentum in the pair

Major Support and Resistance Levels:

Support - 109.22 (5-DMA), 108.90 (converged 200W MA and 21-EMA), 108.74 (20-DMA)

Resistance - 109.81 (Upper BB), 110, 110.67 (88.6% Fib)

Summary: USD/JPY was extending choppy trade around 5-DMA. Technical analysis supports upside in the pair. Focus on Friday's non-farm payrolls data for impetus.