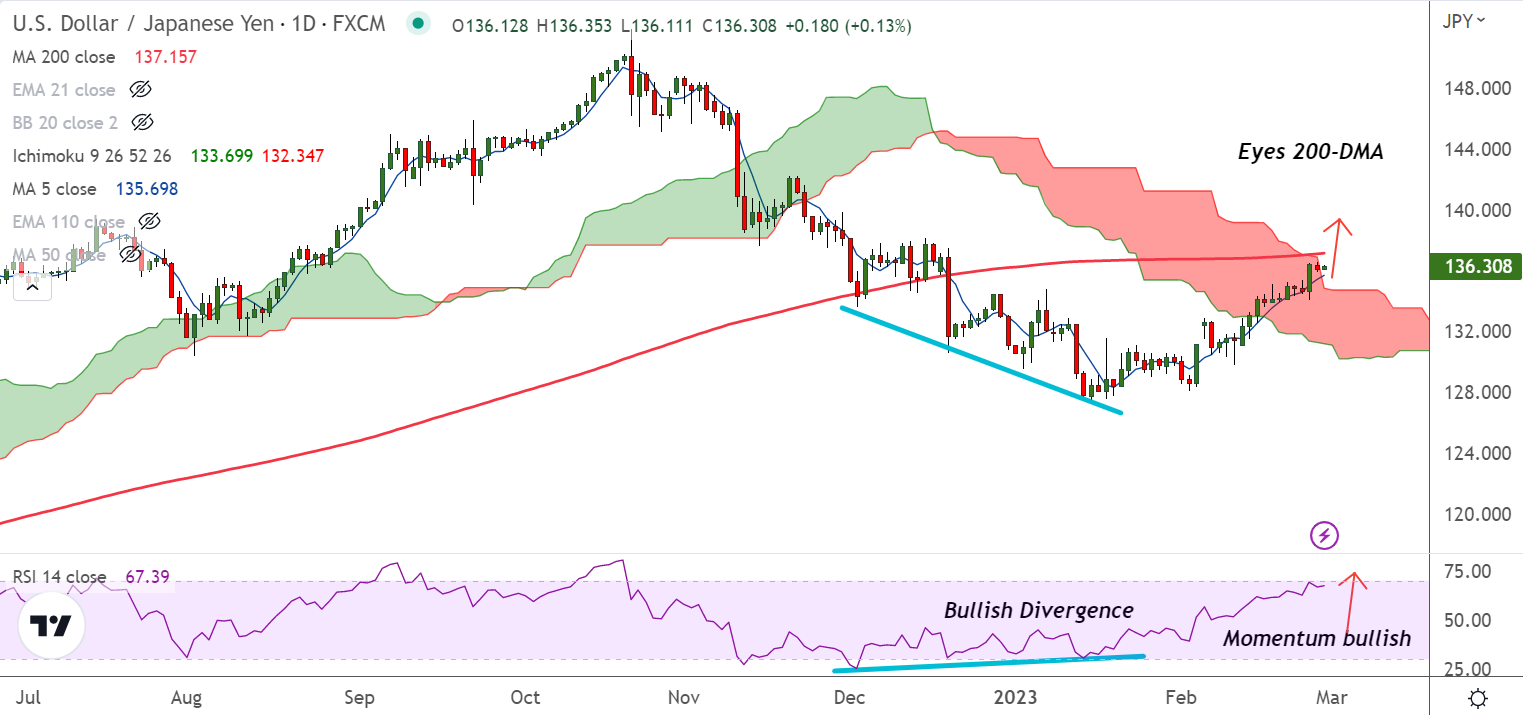

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.16% higher on the day at 136.34 at around 05:30 GMT.

Previous Week's High/ Low: 136.51/ 133.91

Previous Session's High/ Low: 136.55/ 135.91

Fundamental Overview:

A surprise dovish tone adopted by Bank of Japan (BoJ) Governor Nominee Kazuo Ueda is impacting the Japanese Yen.

On the data front, annual Japan’s Retail Trade (Jan) rose to 6.3% vs. consensus of 4.0% and the prior release of 3.8%. However, the Japanese Yen unimpressed.

Further, Japan Industrial Production (IP) for January shrunk 4.6% versus -2.6% expected and 0.3% prior growth.

On the US front, Durable Goods Orders fell -4.5% in January vs. -4.0% expected and 5.1% prior. However, the Nondefense Capital Goods Orders ex Aircraft grew 0.8% vs. 0.0% expected and -0.3% prior.

US Pending Home Sales rallied 8.0% MoM versus 1.0% expected and compared to 1.1% in the prior month.

Mixed US data along with the hawkish Fed speak and the US-China tension keep the pair sidelined. Risk catalysts will influence price action.

Technical Analysis:

- USD/JPY extends previous session's range trade below 200-DMA

- Momentum is bullish, volatility is high and rising

- GMMA indicator shows minor trend is bullish, while major trend is turning bullish

- MACD and ADX support upside in the pair, Chikou span is biased higher

Major Support and Resistance Levels:

Support - 135.70 (5-DMA), Resistance - 137.15 (200-DMA)

Summary: USD/JPY trades with a bullish bias. 200-DMA is major hurdle at 137.15, decisive break above required for upside continuation.