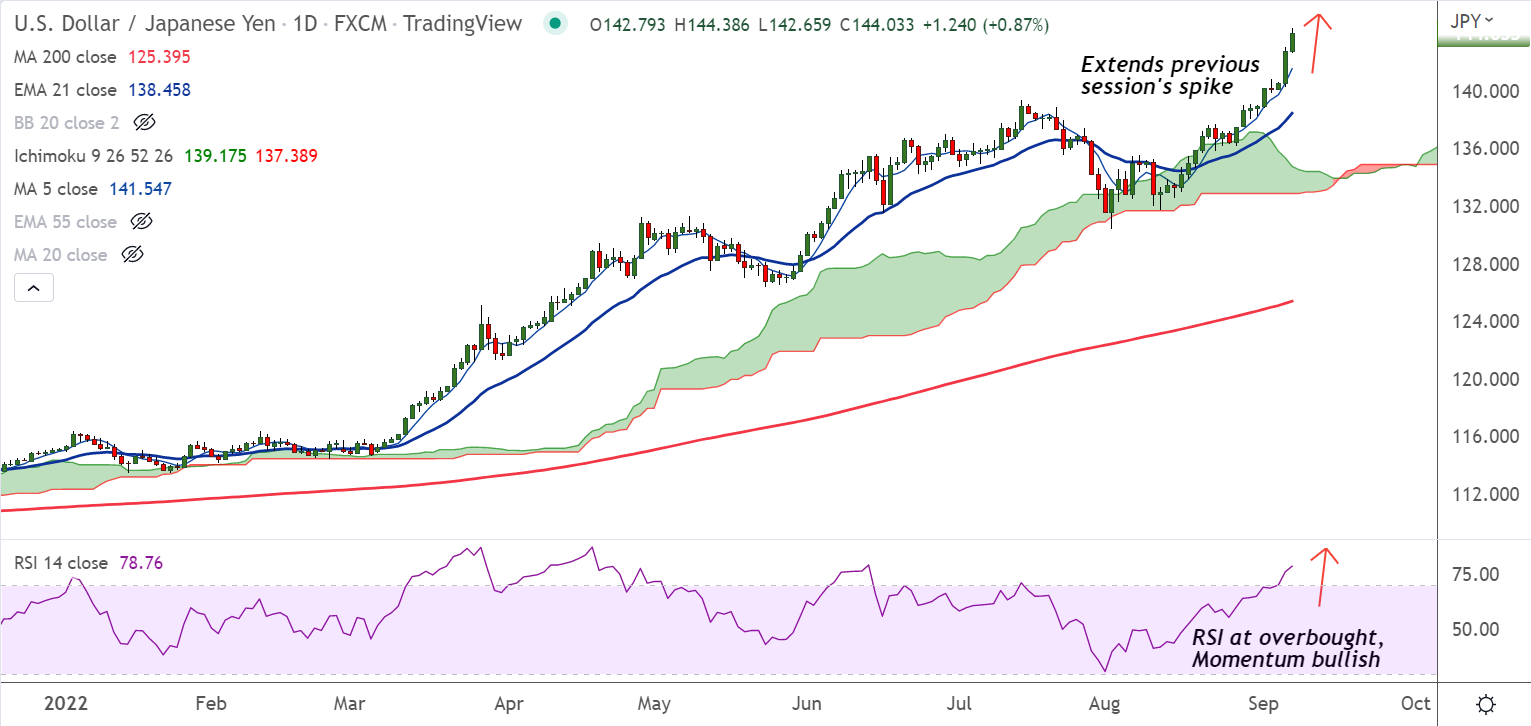

Chart - Courtesy Trading View

USD/JPY was trading 0.92% higher on the day at 144.11 at around 05:50 GMT.

The pair is extending previous session's gains, after closing 1.58% higher in the previous session.

US ISM Services PMI rose to 56.9, above 55.1 market forecast and compared to 56.7 in the prior month.

However, the S&P Global Composite PMI and Services PMI eased to 44.6 and 43.7 respectively versus 45.0 and 44.1 expected.

Markets pricing of 0.75% Fed rate hike in September increased after firmer US data, boosting the US dollar across the board.

Looking forward, the monthly prints of the US trade balance and Fed Beige Book updates will be in focus for impetus.

Technical bias for the pair is strongly bullish. That said, overbought oscillators raise scope for some pullback.

Major Support Levels:

S1: 141.58 (5-DMA)

S2: 138.47 (21-EMA)

Major Resistance Levels:

R1: 145

R2: 147.67 (1998 high)

Summary: USD/JPY trades with a strong bullish bias. Eyes fresh 24-year high. Bullish invalidation only below daily cloud.