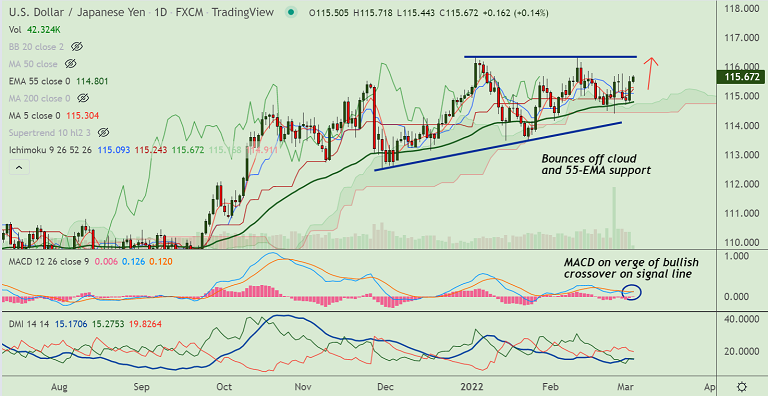

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.13% higher on the day at 115.65 at around 05:05 GMT

Previous Week's High/ Low: 115.76/ 114.40

Previous Session's High/ Low: 115.68/ 114.78

Fundamental Overview:

US dollar continues to draw safe-haven flows amid a 25bps rate hike hinted by Fed Chair Jerome Powell next week.

US Federal Reserve (Fed) chair Jerome Powell, in his testimony on Wednesday, underpinned a 25 basis points (bps) interest rate hike in March’s monetary policy meeting.

Focus remains on Ukraine-Russia peace talks. If risk-aversion intensifies, yen could find demand, weighing on the pair.

On the data front, focus will be on US Initial Jobless Claims and ISM Services PMI, which are due later on Thursday for further impetus.

Technical Analysis:

- USD/JPY extends bounce off 55-EMA and daily cloud

- GMMA indicator shows major and minor trend are bullish on the daily and weekly charts

- Stochs and RSI are biased higher, momentum is with the bulls

- MACD is on verge of bullish crossover on signal line

Major Support and Resistance Levels:

Support - 114.80 (55-EMA), Resistance - 116.30 (Trendline)

Summary: USD/JPY trades with a bullish bias. Scope for test of major trendline resistance at 116.30. Bullish invalidation on retrace below 55-EMA.