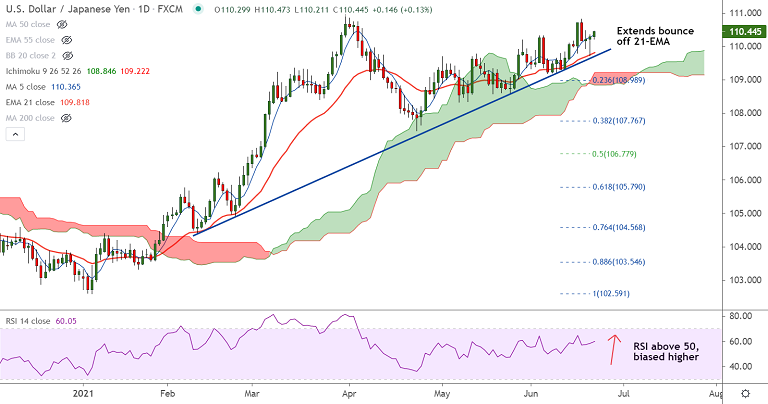

USD/JPY chart - Trading View

Spot Analysis:

USD/JPY was trading 0.12% higher on the day at 110.42

Previous Week's High/ Low: 110.82/ 109.60

Previous Session's High/ Low: 110.35/ 109.71

Fundamental Overview:

US dollar on the front-foot as investors turn optimistic following the latest Fedspeak.

Also favoring the market sentiment could be firmer US Treasury yields and easing covid woes in Asia.

US 10-year Treasury yields stay firmer after bouncing off a four-month low the previous day.

Focus now on Fed Chair Jerome Powell’s testimony to confirm no threats to the easy money policies.

Technical Analysis:

- USD/JPY has bounced off 21-EMA with hammer formation on the previous session's candle

- GMMA indicator shows major and minor trend are strongly bullish

- MACD and ADX support gains, momentum is bullish

- Price action is above cloud and Chikou span is biased higher

Major Support and Resistance Levels:

Support - 110 (200H MA), 109.81 (21-EMA), 109.21 (55-EMA)

Resistance - 110.66 (Upper BB), 110.75 (Trendline), 111.39 (76.4% Fib)

Summary: USD/JPY is poised to resume upside. Technicals favour bulls. Focus on Powell's testimony for impetus. Break above trendline resistance will buoy bulls.