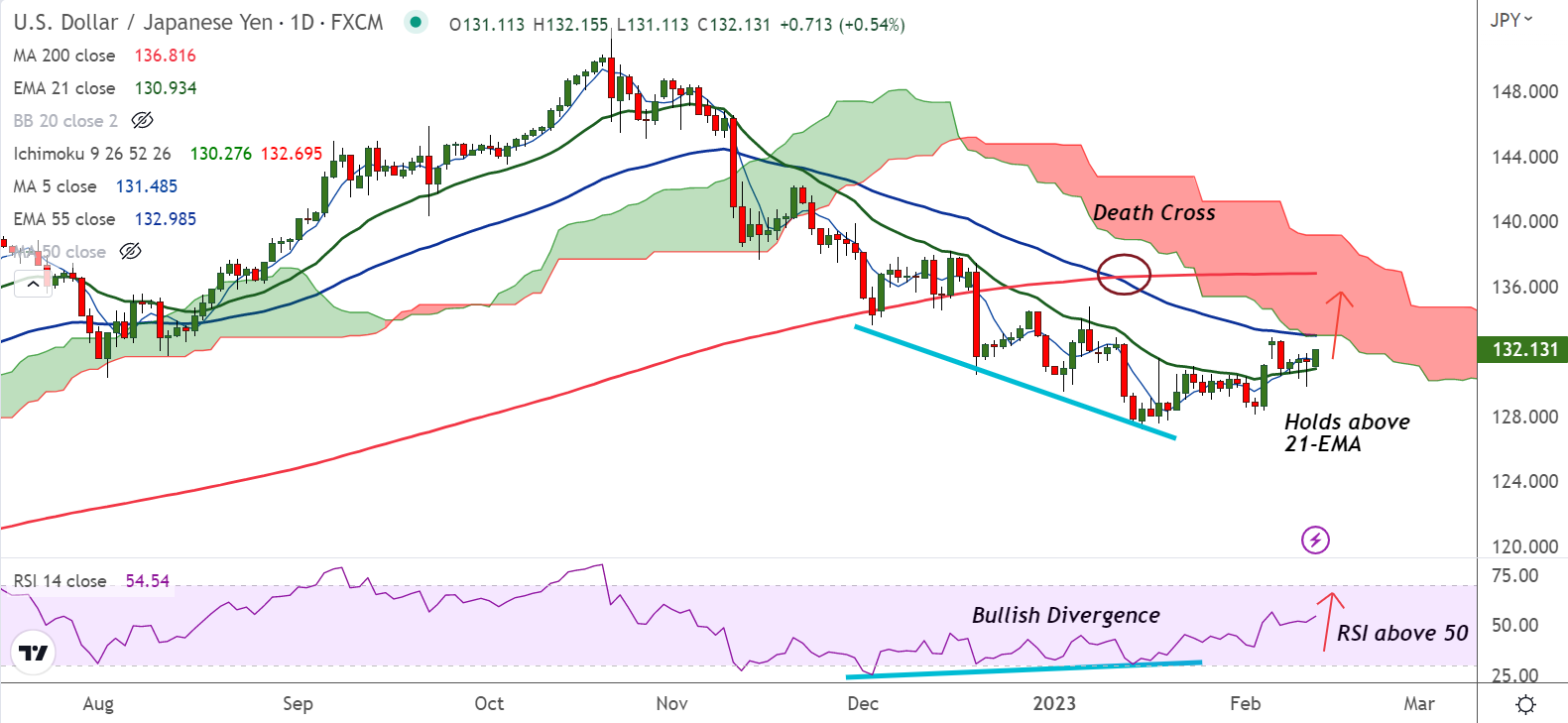

Chart - Courtesy Trading View

USD/JPY was trading 0.53% higher on the day at 132.10 at around 04:45 GMT, bias remains bullish.

The pair has held 21-EMA support and failure to close below has raised scope for upside resumption.

Risk aversion amid fears of US-China tussle, hawkish Fed and cautious mood ahead of key data support the US Dollar.

On the other side, the Japanese Yen stays depressed after possible BoJ Governor Kazuo Ueda voiced his support for the current dovish monetary policy.

Ueda on Friday stated that the current monetary policy is appropriate and added that the central bank needs to continue the easy policy.

U.S. data on consumer prices and retail sales this week will determine near-term direction. Headline and core consumer prices are expected to rise 0.4% for the month, while sales is likely to rebound by 1.6%.

Major Support Levels:

S1: 131.49 (5-DMA)

S2: 130.93 (21-EMA)

Major Resistance Levels:

R1: 132.98 (55-EMA)

R2: 134.93 (110-EMA)

Summary: USD/JPY trades with a bullish bias. Weakness only on break below 21-EMA. Scope for test of 55-EMA and cloud top at 133 level.