• The USD/JPY edged higher on Thursday as yen remained under pressure as the focus turned to the BoJ meeting.

• The BoJ is scheduled to announce its decision on Friday and is expected to maintain the status quo after raising the overnight interest rate to 0.75%, or the highest in 30 years in December..

• Investors will scrutinize Governor Kazuo Ueda's remarks during the post-decision press conference for cues about the timing of the next rate hike.

•The Bank of Japan is likely to lift its growth outlook on Friday and hint at further rate hikes as yen weakness and strong wage growth prospects fuel inflation concerns.

•Markets will also watch Ueda’s post-meeting press conference for policy cues, especially on how the BOJ balances curbing yen weakness while limiting further bond yield rises.

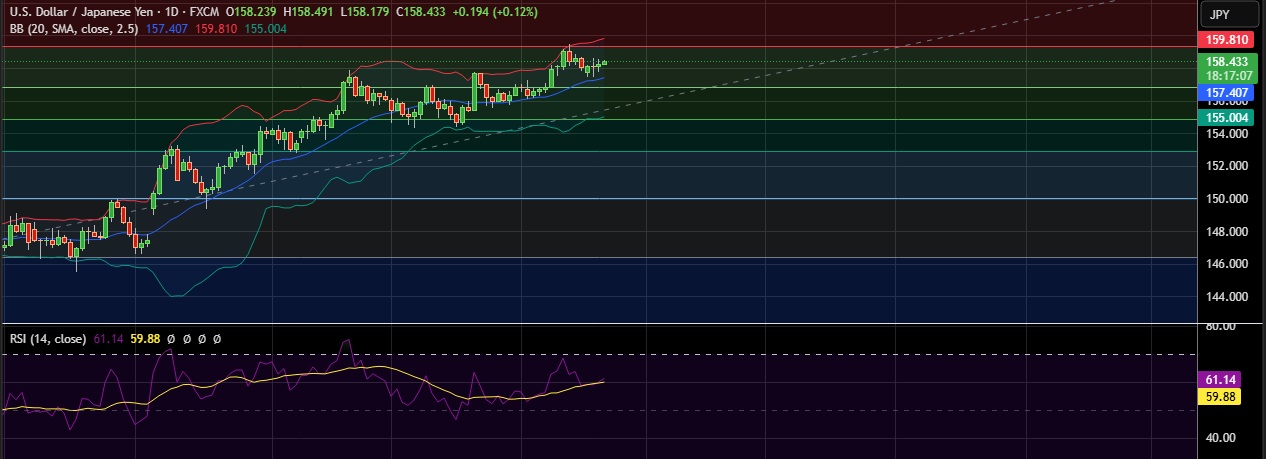

• Immediate resistance is located at 159.35(23.6%fib), any close above will push the pair towards 159.79 (Higher BB).

• Support is seen at 157.45(SMA 20) and break below could take the pair towards 156.77 (38.2%fib)

Recommendation: Good to buy around 158.30, with stop loss of 157.50 and target price of 159.50