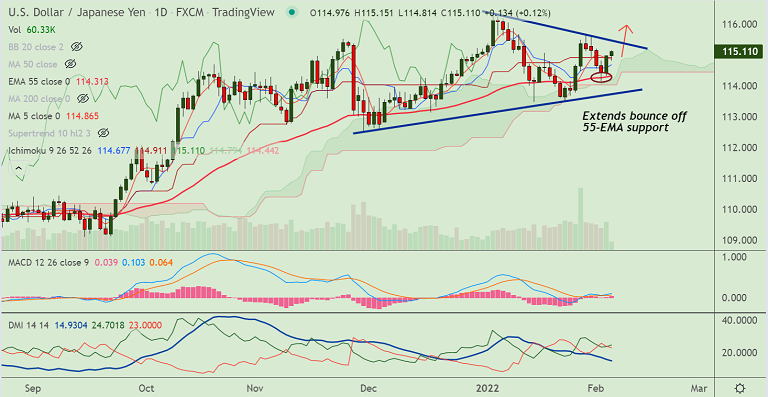

Chart - Courtesy Trading View

USD/JPY was trading 0.14% higher on the day at 115.13 at around 08:20 GMT, bias neutral.

The pair is extending previous session's gains but upside lacks traction as caution prevails ahead of US Non-Farm-Payrolls data.

Data released on Thursday showed the ISM Non-Manufacturing PMI for January came at 59.9, higher than 59.5 forecasted, but trailed December’s 62.3 reading.

Initial Jobless Claims for the week ending on January 29 came at 238K, better than the 245K expected and lower than the previous week revised upwards, to 261K.

Price action remains rangebound as market participants await the release of the US monthly jobs data.

US NFP is expected to show that the economy added 150K jobs in January, down from the 199K reported in the previous month.

Any disappointment in data would weigh on the already weaker USD and drag the pair lower.

Technical analysis points to further upside in the pair. Next major hurdle lies at 115.50 (Trendline). Bullish invalidation likely below 55-EMA.