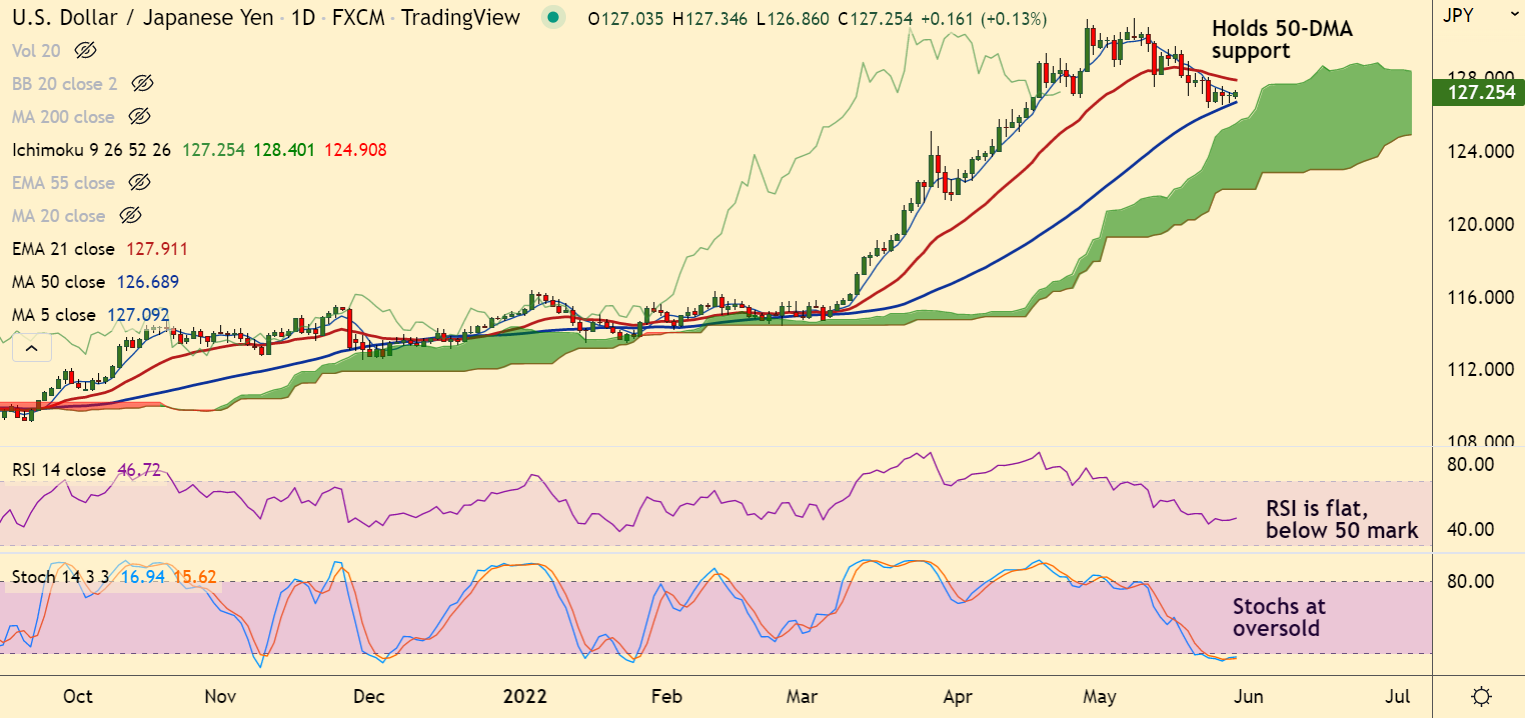

Chart - Courtesy Trading View

USD/JPY was trading in tight range with session high at 127.34 and low at 126.86 at around 06.25 GMT.

The pair is extending sideways grind above 50-DMA support and was trading 0.06% higher on the day at 127.16 at around 07:00 GMT.

Risk-on impulse has seen participants dump US dollar, US dollar index (DXY) has tumbled in the early trade to its monthly lows at 101.38.

Focus remains on the US Non-Farm-Payrolls data and a lower forecast has compelled the market participants to dump the USD.

Analysts expect the preliminary estimate for the US NFP to print at 310k against the prior print of 428k.

Technical analysis for the pair does not provide any clear direction. RSI is flat and Stochs are at oversold levels.

Price action is holding support at 50-DMA, breach below will plummet prices. Dip till daily cloud likely.

On the other side, 21-EMA is strong resistance at 127.91. Break above will see upside continuation.