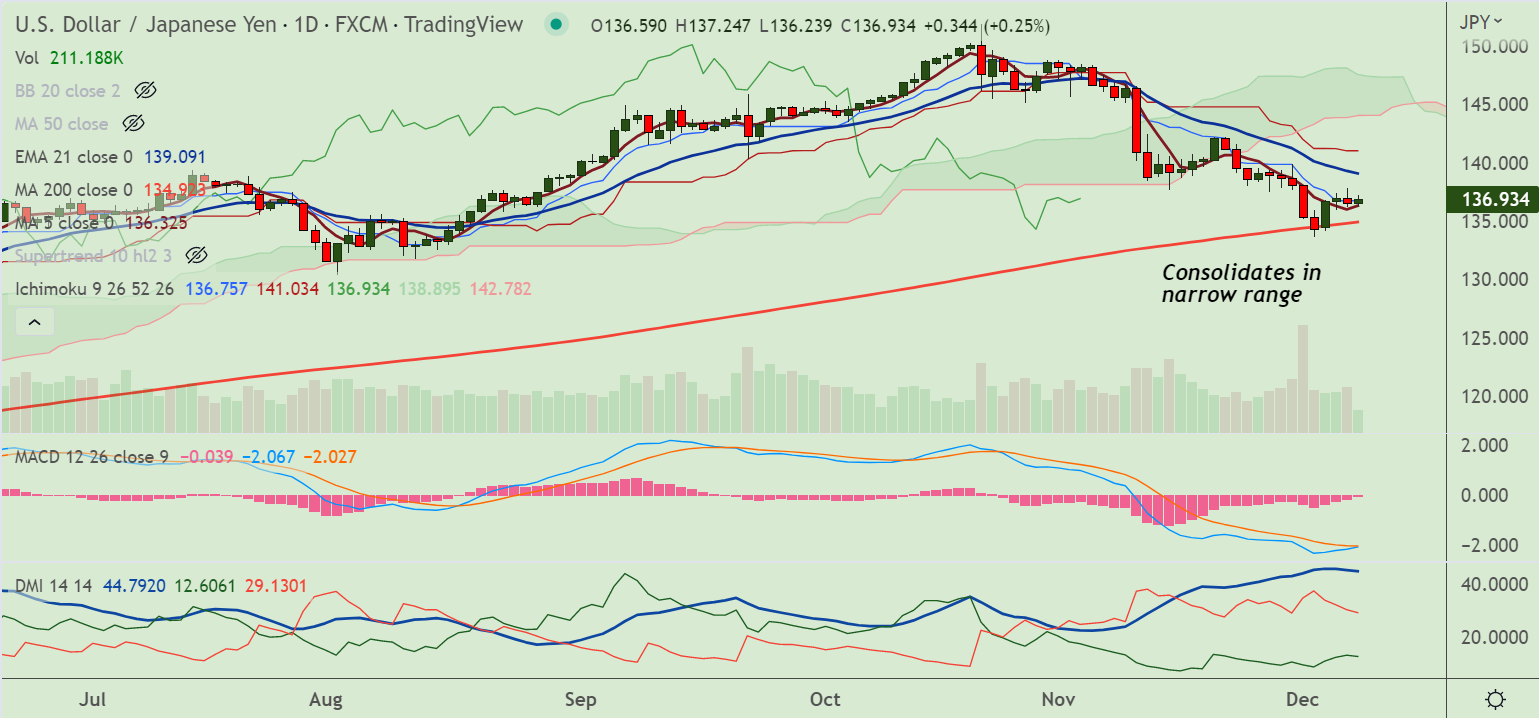

Chart - Courtesy Trading View

USD/JPY was trading 0.19% higher on the day at 136.84 at around 11:40 GMT. The major was extending range trade for the 3rd straight session.

S&P500 futures seem to be under selling pressure again, portraying a rebound in the risk aversion theme.

US recession fears have spooked investors’ sentiment, weighing on the market sentiment.

After supportive data, higher interest rate guidance is expected from Fed chair Jerome Powell in December monetary policy meeting.

The 10-year US Treasury yields have slipped to near 3.45% as the risk-off is regaining traction.

Technical bias for the pair is neutral. Major weakness only below 200-DMA. 21-EMA at 139.08 is major resistance, decisive break above will see more upside.