- USD/JPY edges higher from 4-month lows at 111.43, is currently trading at 111.53.

- The pair is trading a narrow range as we head into the European session.

- Markets largely ignored Fed's Kaplan's comments, citing 3 US rate hikes this year as a 'reasonable' baseline case.

- Upbeat Japanese trade balance data along with risk-off adds to the ongoing Yen strength.

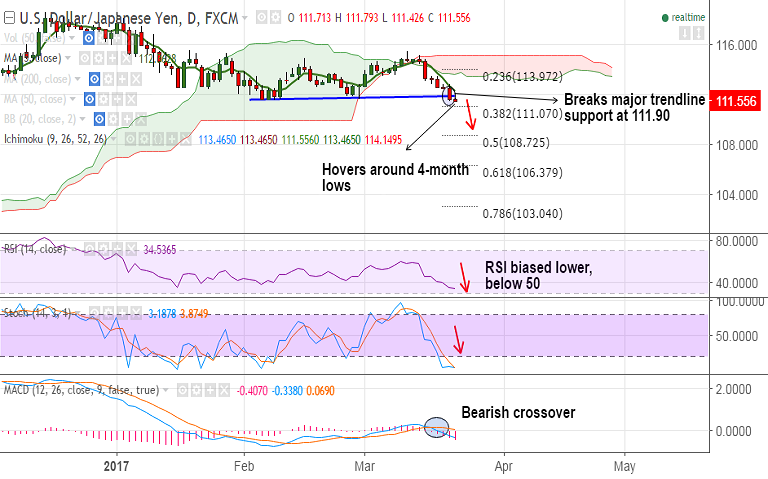

- On the charts we see strong support by weekly cloud at 111.27, break below required for further weakness.

- Violation at weekly cloud will see drag upto 110 (weekly 200-SMA).

- Technical studies are biased lower, bearish invalidation only above 113.45 (20-DMA).

Call update: Our previous call (http://www.econotimes.com/FxWirePro-USD-JPY-breaks-below-100-DMA-good-to-go-short-on-rallies-597637) has hit TP1.

Recommendation: Book partial profits at lows, hold for downside.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -29.1856 (Neutral), while Hourly JPY Spot Index was at 162.893 (Highly bullish) at 0600 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.