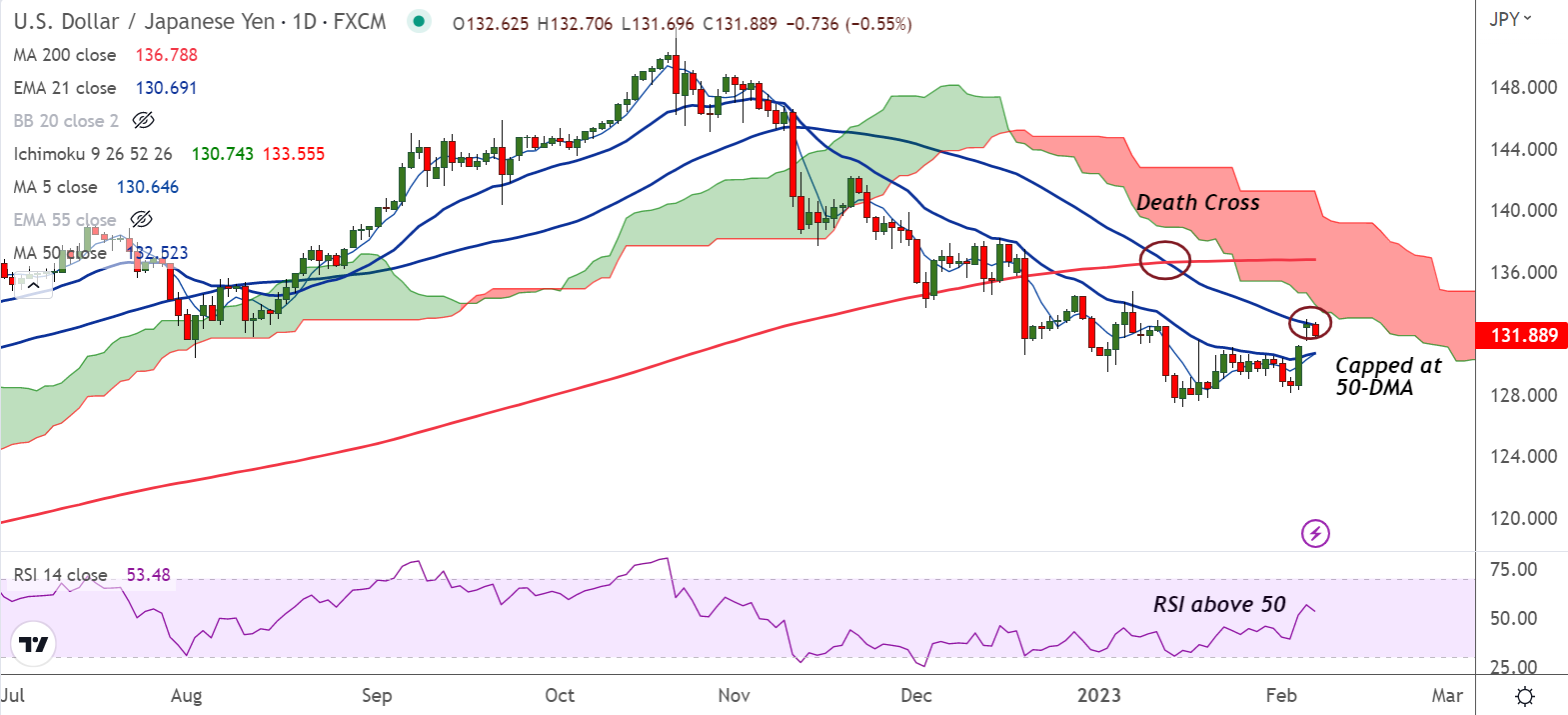

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.62% lower on the day at 131.80 at around 09:15 GMT.

Previous Week's High/ Low: 131.20/ 128.08

Previous Session's High/ Low: 132.90/ 131.51

Fundamental Overview:

Hawkish concerns surrounding the Bank of Japan’s (BoJ) next moves and Japan’s money market interventions seem to challenge the USD/JPY bulls.

The pair sees selling interest after the Bank of Japan (BoJ) has confirmed a stealth intervention to provide support to the Japanese Yen.

On the data front Japanese Labor Cash Earnings has increased by 4.8%, higher than the consensus of 0.9% and the former release of 0.5%.

Stronger-than-expected Japanese Labor Cash Earnings indicate that wage inflation is effectively increasing and could propel the overall inflation ahead.

Later the day, the speech from Fed chair Jerome Powell will be keenly watched for cues about the central bank's likely monetary policy action ahead.

Technical Analysis:

- USD/JPY finds rejection at 50-DMA

- Price action is below cloud and 200-DMA

- Momentum is bullish and volatility is high

- Death Cross on the daily charts keeps bearish bias

Major Support and Resistance Levels:

Support - 130.67 (21-EMA), Resistance - 132.52 (50-DMA)

Summary: USD/JPY pivotal at 50-DMA, decisive break above required for upside continuation.