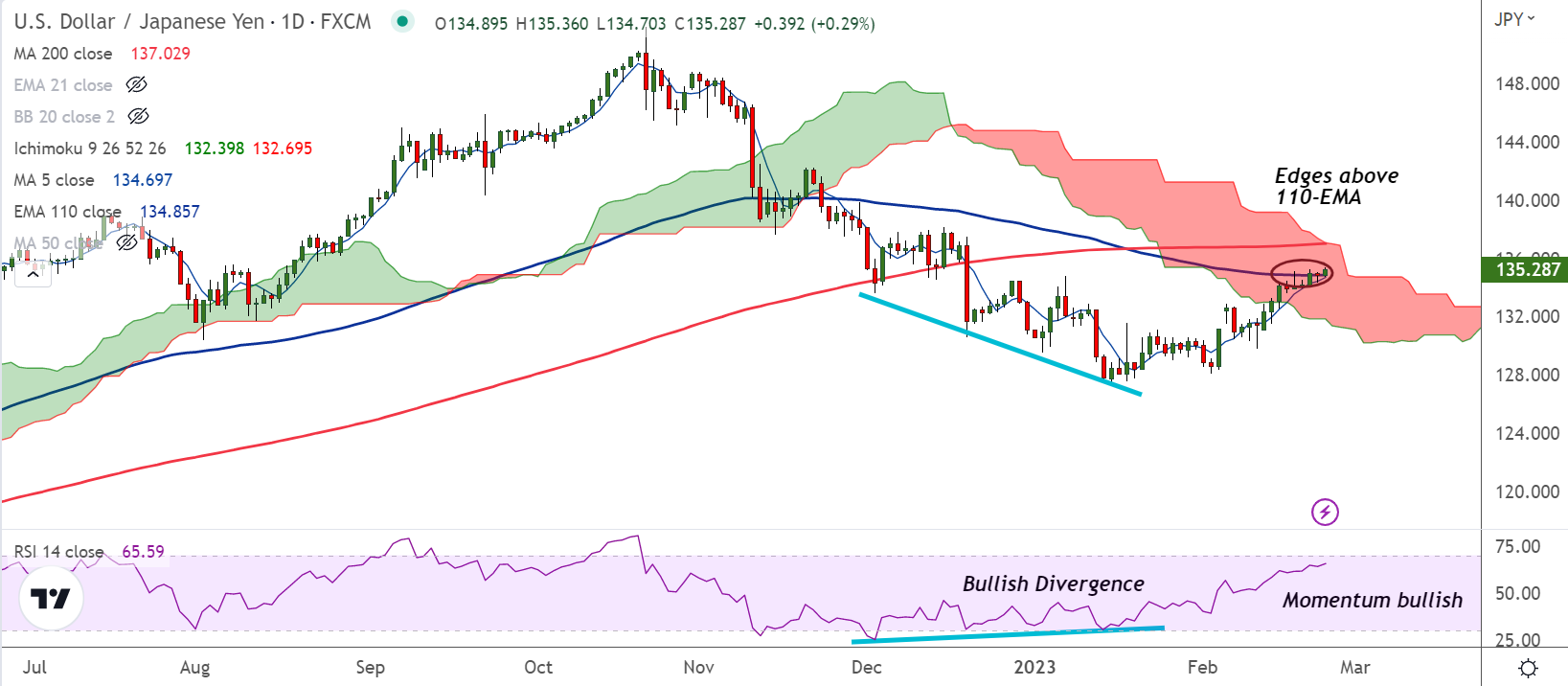

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.25% higher on the day at 135.24 at around 13:55 GMT.

Previous Week's High/ Low: 135.11/ 131.11

Previous Session's High/ Low: 135.05/ 134.36

Fundamental Overview:

US Initial Jobless Claims unexpectedly fell to 192K during the week ended February 17, below expectations for a reading of 200K.

Seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 191,250, an increase of 1,500 from the previous week's revised average.

US Personal Consumption Expenditures Prices (QoQ)(Q4) PREL printed at 3.7% above expectations and prior reading of 3.2%

The Fed'd preferred measure of inflation the Core PCE Price Index also came in higher-than-expected at 4.3%, above 3.9% expected and prior.

Data shows underlying strength in the US labour market, which, along with persistently high inflation, supports the Fed's hawkish rate path guidance.

US Q4 GDP, showed that the world's largest economy expanded by a 2.7% annualized pace against the 2.9% rise expected.

Further, Chicago Fed National Activity Index recovered sharply in January to to 0.23 from -0.46 in December, better than the market expectation of 0.03.

Technical Analysis:

- USD/JPY has edged past strong resistance at 110-EMA

- Momentum is bullish, RSI is well above the 50 mark

- GMMA indicator shows minor trend is bullish, while major trend is turning bullish

- MACD and ADX support upside in the pair

Major Support and Resistance Levels:

Support - 134.67 (5-DMA), Resistance - 137.02 (200-DMA)

Summary: USD/JPY close above 110-EMA will see upside continuation. Next major resistance lies at 200-DMA at 137.02.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out