The constructive market sentiment is weighing on the Japanese yen, however, the monetary policy outlook indicates that the appreciation trend of the Japanese currency is not yet over, though less in demand as a safe haven. USDJPY has been trading in range-bounded trend (currently, trading at 111.222 levels) so far.

The JPY has been one of the outperformers this year so far. The initial reason for the yen's strength was fears of a global recession that had arisen recently which fuelled demand for the Japanese currency as a safe haven. Bank of Japan (BoJ) is scheduled for its monetary policy on this Thursday, we ruled out slow normalization of monetary policy, as inflation in Japan has so far made no attempt to approach the BoJ's 2% inflation target.

The BoJ is no longer expected to raise the yield target in 2020 given the downgraded inflation outlook.

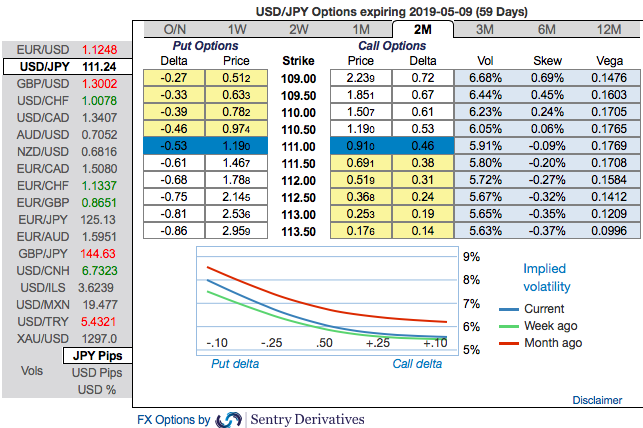

USDJPY OTC update is as follows: Most importantly, the positively skewed IVs of 2m tenors are still signifying the hedging interests for the bearish risks. The bids for OTM put options of these tenors signal that the underlying spot FX likely to break below 109 levels so that OTM instruments would expire in-the-money.

Please also be noted that the mounting numbers of bearish risk reversals of USDJPY across all tenors that are also substantiating downside risks amid momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The Market Pin Risk report also shows large options expiring at 109.45 levels in the next 5 days. Red strikes indicate sizeable open interest close to the current forex spot rate. FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices (in this case, USDJPY has the highest interest towards forward point at 109.45). The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, a couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 111.222 levels, contemplating 2m skews and risk reversals, buy a 2M/1w 111.50/109 put spread (vols 5.93 vs 5.41 choice), wherein short leg is likely to function as the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. Courtesy: Tradingview.com, Sentrix and Saxo

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 92 levels (which is bullish), while hourly USD spot index was at 34 (mildly bullish) while articulating at (10:27 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch