We foresee the divergence in monetary policies of Fed and BoJ has been helping to weaken the yen to 110 to 120 against the dollar by the end of 2017.

The Japanese central bank switch of focus to controlling the government bond yield curve from hoarding debt would assist in preventing yen gains hurting the economy.

The currency could weaken significantly if expectations overseas for inflation pick up and moderate growth of around 2 pct in the U.S. can be achieved, facilitating Federal Reserve rate increases.

OTC updates:

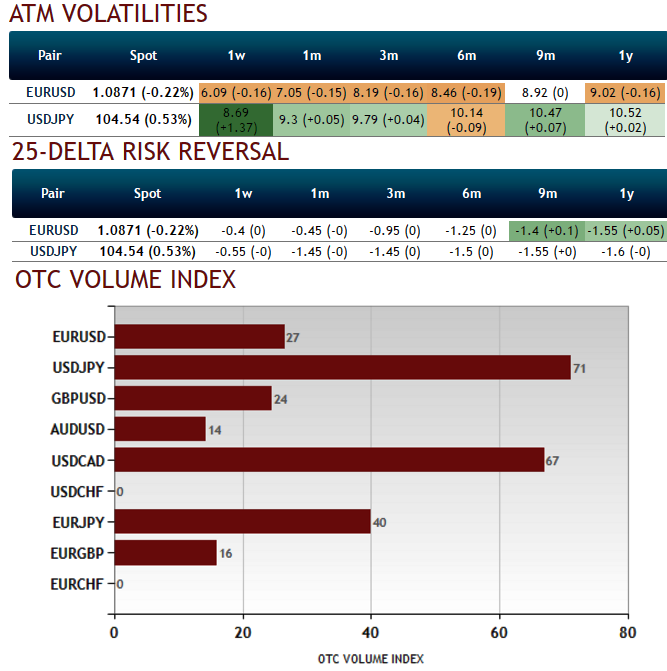

As per the nutshell showing implied volatilities and delta risk reversals, USDJPY is rising higher IVs of 1w tenors with hedging sentiments for downside risks in the tenor. Whereas the long-term hedging arrangements for downside risks still appear to be intact. Hence, we recommend below option strategy so as to match the above fundamental as well as the OTC scenarios.

While USDJPY pin risk is seen in options expiring on this Friday at strikes 103.75, most importantly, as you could make out from the OTC VIX USDJPY is the pair to have highest volumes. By this we mean FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices. That is, the spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Option Trade Recommendation:

USDJPY is currently trading at around 104.075 (edging higher 4-weeks highs). So while the market is happy to buy USDJPY as a positively convex play on the next BoJ meeting, the result of such demand is that USDJPY is now 2% expensive compared to the 10Y rate spread. On hedging grounds, hold a USDJPY put fly (104.777x103.844x103.223 in 1x2x1 notional) with 2w expiry.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says