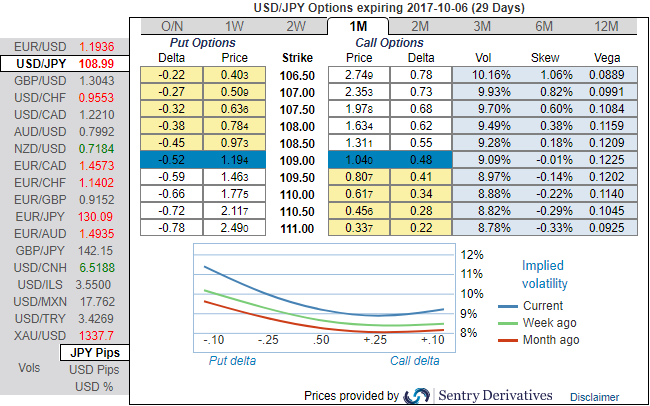

We came across the implied volatility of ATM contracts of USDJPY across all tenors are shrinking lower, just shy above 9.5%, while risk reversals have been bearish neutral.

The rationale is that any abrupt upswings should be optimally utilized in order to arrest potential downswings to the maximum extent regardless of trading or hedging grounds, so to participate in that downtrend, weights in the portfolio should be increased with more number of put contracts but consciously while choosing the right instruments.

Implied volatility is an important factor to consider in options trading because the prices of options are directly affected by it. A spot rate with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive.

Please be noted that the IV skewness is very useful in determining this decision, here in case of USDJPY, one could easily make out positively skewed IVs are signifying the importance of OTM puts but not deep out of the money puts (1m skews are suggesting strikes maximum upto 106.50). And also be noted that this bearish sentiment is also substantiated by the mounting negative risk reversals that again indicates further bearish risks.

Well, this is intuitive due to the higher likelihood of the market 'swinging' in your favor. If IV increases and you are holding an option, this is good. In contrast, if it goes in an adverse direction, then one should raise a cause of concern for his options strategy.

A smart approach to tackle this obstacle and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts or OTM strikes but certainly not deep OTM strikes.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -50 (which is bearish), while hourly JPY spot index was at 10 (neutral) at 07:26 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data