Ahead of the US CPI prints, USD treasury currency report, crude oil inventories, these event risks which are the major focus for this week, USDJPY OTC update is as follows:

Most importantly, please be noted that the positively skewed IVs of 1m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 110.00 levels so that OTM instruments would expire in-the-money.

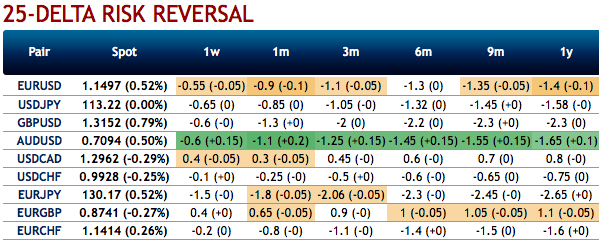

While bearish neutral risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid momentary upswings in the short-run. IVs for 1w tenors are shrinking away which is good for put option writers, and 1m IVs are on higher side which is good for put holders.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The Market Pin Risk report shows large options expiring in the next 5 days. Red strikes indicate sizeable open interest close to the current forex spot rate. FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices (in this case, USDJPY has the highest interest towards forward point at 113.85). The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Accordingly, couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 112.284 levels, buy a 1m/1w 113.85/110.00 put spread (vols 7.60 vs 7.58 choice), wherein short leg is likely to function as the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -78 levels (which is bearish), while hourly USD spot index was at 91 (bullish) while articulating at (09:34 GMT). For more details on the index, please refer below weblink:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge