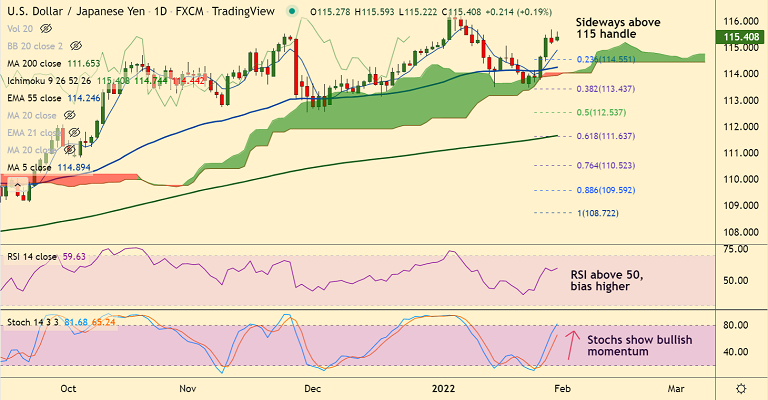

Chart - Courtesy Trading View

Technical Analysis:

GMMA Indicator

- GMMA indicator shows major and minor trend are bullish

- Scope for bullish continuation

Ichimoku Analysis

- Price action is extending bounce off daily cloud support

- Chikou span is biased higher, scope for further upside

Oscillators

- Stochs and RSI are biased higher, RSI is well above the 50 mark

- Momentum is with the bulls

Bollinger Bands

- Bollinger bands are spread wide apart

- Shows volatility is high and could carry the bullish momentum

Major Support Levels: 114.89 (5-DMA), 114.66 (21-EMA), 114.38 (200H MA)

Major Resistance Levels: 116, 116.13 (Upper W BB), 116.66 (88.6% Fib)

Summary: USD/JPY was trading with a bullish bias. Scope for upside resumption. Bullish invalidation only below daily cloud.