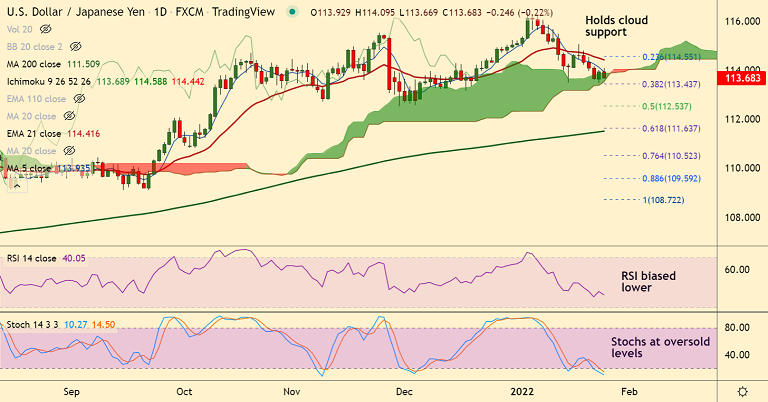

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

GMMA Indicator

- Major trend is neutral, while minor trend is bearish

Ichimoku Analysis

- Price action is holding support at daily cloud

- Chikou span is biased lower

Oscillators

- Momentum oscillators are strongly bearish

- RSI is below 50 and biased lower, Stochs are at oversold

Bollinger Bands

- Bollinger bands are spread wide apart

- Volatility is high and rising

Major Support Levels: 113.43 (38.2% Fib), 113.35 (Lower BB), 113.14 (110-EMA)

Major Resistance Levels: 113.93 (5-DMA), 114.41 (21-EMA), 114.55 (23.6% Fib)

Summary: USD/JPY extends sideways at cloud support, break below will see more weakness. Technical bias is bearish, scope for test of 110-EMA at 113.14. Bearish invalidation only above 21-EMA.