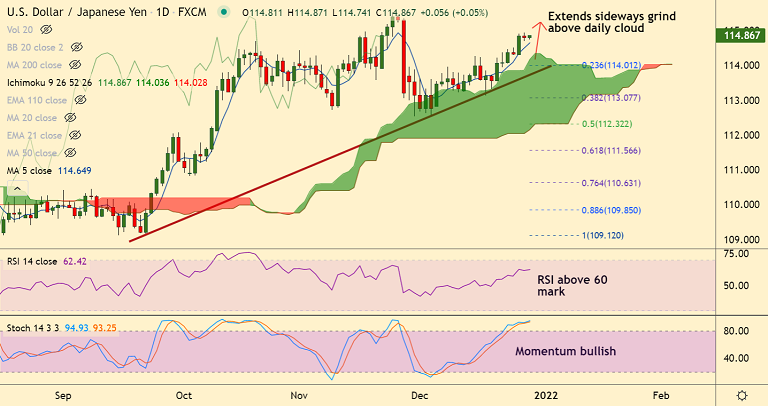

Chart - Courtesy Trading View

Technical Analysis: Bias Bullish

GMMA Indicator

- Major and minor trend are strongly bullish

Ichimoku Analysis

- Price action has bounced off daily cloud support

- Chikou span is biased higher, supporting further gains

Oscillators

- Stochs and RSI are sharply higher, momentum is bullish

- Stochs are at overbought levels, but no signs of reversal seen

Bollinger Bands

- Bollinger bands are spread wide apart and gap is increasing

- Volatility is high and rising, scope for bullish continuation

Major Support Levels: 114.64 (5-DMA), 114.08 (21-EMA), 113.84 (20-DMA)

Major Resistance Levels: 115, 115.52 (Nov high), 116

Summary: USD/JPY is extending sideways for the second consecutive session, but technical bias remains bullish. Scope for test of 115 levels.