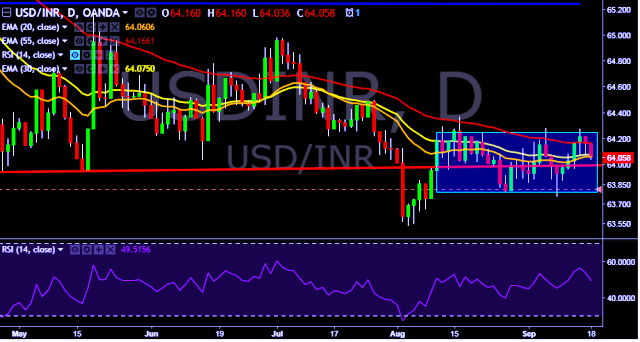

- USD/INR is currently trading around 64.05 marks.

- It made intraday high at 64.16 and low at 64.03 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 64.22 marks.

- Key resistances are seen at 64.22, 64.36, 64.48, 64.60, 64.82, 64.98, 65.09, 65.18, 65.34, 65.52 and 65.80 marks respectively.

- On the other side, initial supports are seen at 63.96, 63.87, 63.70, 63.62, 63.48, 63.36 and 63.11 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- India’s NSE Nifty was trading around 0.70 percent higher at 10,156.55 points and BSE Sensex was trading at 0.63 percent higher 32,474.91 points.

We prefer to take short position in USD/INR around 64.08, stop loss at 64.22 and target of 63.87.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest