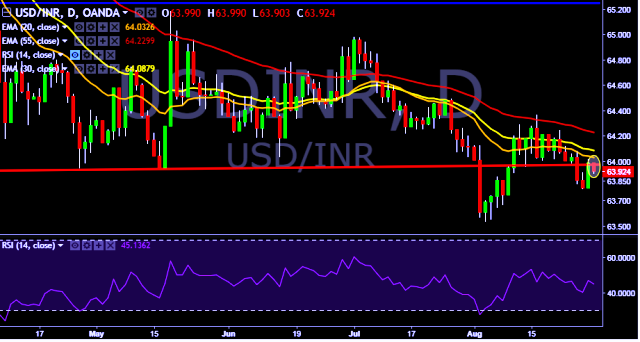

- USD/INR is currently trading around 63.92 marks.

- It made intraday high at 63.99 and low at 63.90 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 64.01 marks.

- Key resistances are seen at 64.01, 64.25, 64.32, 64.48, 64.60, 64.82, 64.98, 65.09, 65.18, 65.34, 65.52 and 65.80 marks respectively.

- On the other side, initial supports are seen at 63.90, 63.82, 63.75, 63.62, 63.48, 63.36 and 63.11 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- India’s NSE Nifty was trading around 0.90 percent higher at 9,883.15 points and BSE Sensex was trading at 0.80 percent higher at 31,634.77 points.

We prefer to take short position in USD/INR around 63.95, stop loss at 64.15 and target of 63.75/63.50.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest