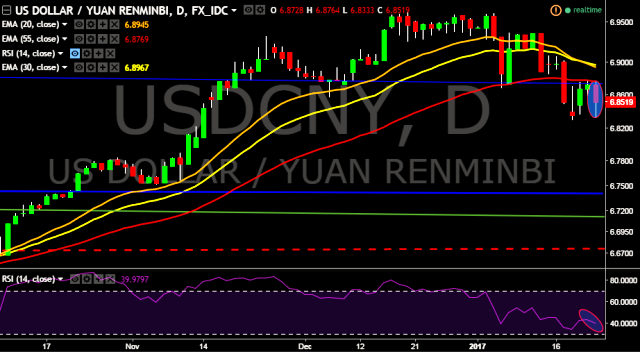

- USD/CNY is currently trading around 6.8511 marks.

- It made intraday high at 6.8764 and low at 6.8333 levels.

- Intraday bias remains bearish for the moment.

- A sustained close above 6.8728 marks will test key resistances at 6.8789, 6.9080, 6.9162, 6.9336, 6.9496, 6.9615, 6.9778 and 6.9883 marks respectively.

- Alternatively, a daily close below 6.8728 will drag the parity down towards key supports at 6.8510, 6.8449, 6.8090 and 6.7769 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- PBOC sets Yuan mid-point at 6.8572/ dollar vs last close 6.8820.

- China's registered urban unemployment rate at 4.02 pct at end-2016 –Xinhua.

We prefer to take short position in USD/CNY around 6.8570, stop loss at 6.8785 and target of 6.8333/6.8298.