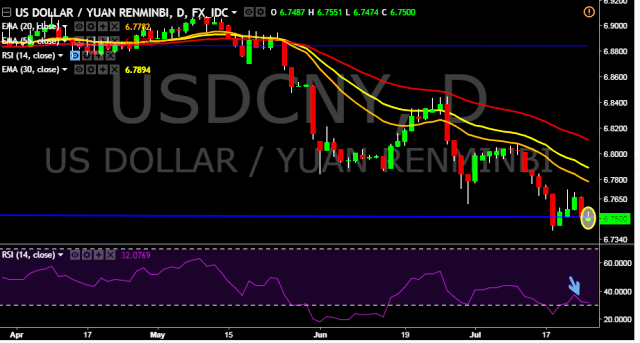

- USD/CNY is currently trading around 6.7501 marks.

- It made intraday high at 6.7575 and low at 6.7474 levels.

- Intraday bias remains neutral for the moment.

- A sustained close above 6.7511 marks will test key resistances at 6.7668, 6.7757, 6.7842, 6.8009, 6.8070, 6.8250, 6.8440, 6.8526, 6.8671, 6.8882, 6.8942, 6.9010 and 6.9080 marks respectively.

- Alternatively, a daily close below 6.7511 will drag the parity down towards key supports at 6.7403, 6.7222 and 6.7118 marks respectively.

- PBOC sets yuan mid-point at 6.7485/ dlr vs last close 6.7502.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest