The Swiss National Bank (SNB) has maintained status quo in its monetary policy today to leave everything unchanged (kept libor rate at -0.75%). Consequently, the development of CHF over the past weeks did not seem to have provided any reason to tighten the monetary policy reins after all. With lingering uncertainty over the Italian budget conflict and Brexit, CHF seems to be much more in demand again recently. During such a circumstance that the SNB does not want to give the FX market any other arguments for trading the franc at stronger levels, which would put pressure on the inflation outlook and domestic exports.

OTC Updates and Options Strategy:

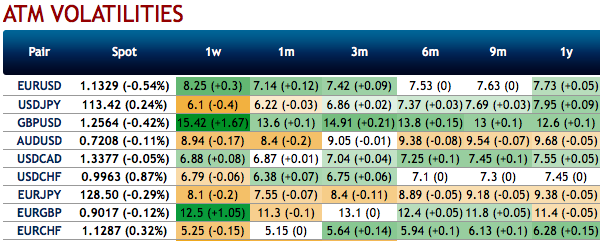

Let’s just quickly glance through above implied volatility (IV) nutshell before deep diving into the strategic frameworks of USDCHF. CHF crosses are showing the least IVs among G10 FX bloc (1m IVs are at 6.38 and 5.15 for USDCHF and EURCHF respectively).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Nevertheless, it is quite possible to calculate the marketplace’s expected future volatility using the option’s price itself which is known as implied volatility (IV). Well, this is quite intuitive owing to the higher likelihood of the underlying spot FX market ‘swinging’ in your favour.

If IV increases and you are holding an option, this is good. On the contrary, if you have short on option, it is not desirable. The option writer likes IV to drop so the premium falls, thereby, the underlying price remains stagnant and he can pocket the initial premium received.

The execution of option trading strategy:Contemplating above rationale, the recommendation would be on buying OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as USDCHF is perceived to have a low volatility.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which the call and put options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

Risk/Returns Profile: The maximum return occurs at ATM strike. A smaller return is made between ATM strikes and the break-even points. The maximum loss is limited by OTM strike prices.

Effect of Volatility: The value of the options will decrease as volatility decreases, which is usually conducive for the strategy. An increase in volatility will be generally bad for the strategy as stated above.

Effect of Time decay: The value of the option decays as each day passes (good).

Margin requirement: Depends on how it is constructed.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -98 levels (which is bearish), while hourly CHF spot index was at -56 (bearish), while articulating (at 08:42 GMT). For more details on the index, please refer below weblink:

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures