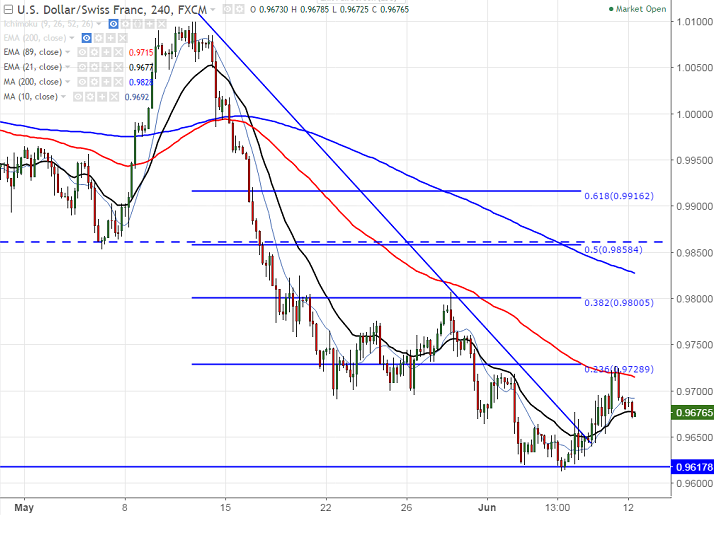

- USD/CHF formed a temporary bottom around 0.9614 and jumped slightly from that level. Intraday bias is still bearish as long as resistance 0.9808 holds. It is currently trading around 0.96738.

- The pair has shown a slight jump above ichimoku cloud in 4H chart and declined slightly after hitting high of 0.97272. Short term bearish invalidation can be seen only above 0.9808.Any break above 0.9808 high made on May 30th 2017 will take the pair till 0.9835 (38.2% retracement of 1.00998 and 0.96220)/0.9900/0.9925 (50- day MA). The minor resistance is around 0.9700 (200- H MA)/0.97360 (61.8% retracement of 0.9808 and 0.96220).

- The pair declined till 0.9620 (100% projection of 1.0342 to 0.9860 from 1.0099. Any daily close below will 0.9617 will drag the pair down till 0.9580/0.95490 (Nov 9th 2016 low).

- Overall bearish invalidation only above 1.03435.

It is good to sell on rallies around 0.9750 with SL 0.9808 for the TP of 0.9650/0.9620.