The Bank of Canada will be cautious at its meeting today and will hope that the NAFTA negotiations can be concluded successfully, which would then give it scope for further rate hikes. That means that for the Canadian dollar the BoC’s rate decision today is an aside. The focus rests clearly on the trade negotiations between the US and Canada that are going to be continued today - it is all or nothing for CAD. Of course, the US is the most important trade partner of Canada by a long margin so that Canada cannot afford to risk the negotiations failing and the trade agreement coming to an end.

However, Canada can rely on important allies in the US: in Congress, where all trade agreements have to be ratified, resistance is forming against an agreement between the US and Mexico, excluding Canada. This strengthens the Canadian negotiating position but also increases the risk of a possible failure of the negotiations. The resulting risk premium is putting pressure on the Canadian dollar. Further losses are possible unless an agreement emerges.

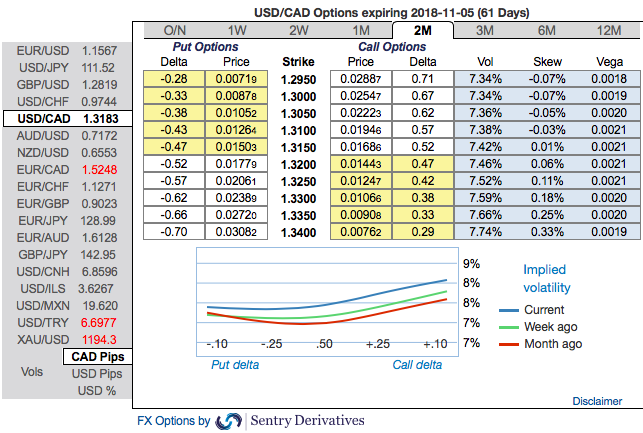

Well, before we proceed further to the core part of our strategies, let’s just just quickly glance through OTC outlook of USDCAD.

All these driving forces seem to be factored-in OTC markets. Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.34 levels (refer above nutshell evidencing IV skews).

Positive bids of risk reversal of loonie (USDCAD) is also signalling bullish risks in across tenors (refer above nutshell showing risk reversals). A risk reversal is an over-the-counter (OTC) structured forward that is predominantly utilized as a hedging solution. The RR proposes the probability of benefiting to a limited extent from an appreciation of the foreign currency you are exposed to.

Since, 1W implied volatility has to decline in a slightly bullish environment in short-term, we recommend a short vega strategy.

Hence, using any prevailing rallies, decide to initiate a bull put spread for net credits, so short 1W (-1%) in the money put with positive theta if you expect that USDCAD will spike up moderately over the next near future but certainly not beyond your imagination, simultaneously, go long in at the money -0.5 delta put option of 3w expiries with a view to arrest abrupt downside risks.

Please be noted that the put you buy has to be at the money and the put you short has to be in the money with an anticipation of USDCAD could rise and remain unchanged within shorter expiration, and there onwards any fall below current spot FX would be taken care by longs in ATM put and also if you have any active longs in spot FX would be protected.

Maximum profit: The initial credit received for this trade which is certain, after 1W if it continues its bearish business cash flows would be exponential.

The maximum risk is the difference between the two strike prices, minus the credit you received.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -77 levels (which is bearish), while hourly USD spot index was at 137 (bullish) while articulating at (12:12 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand