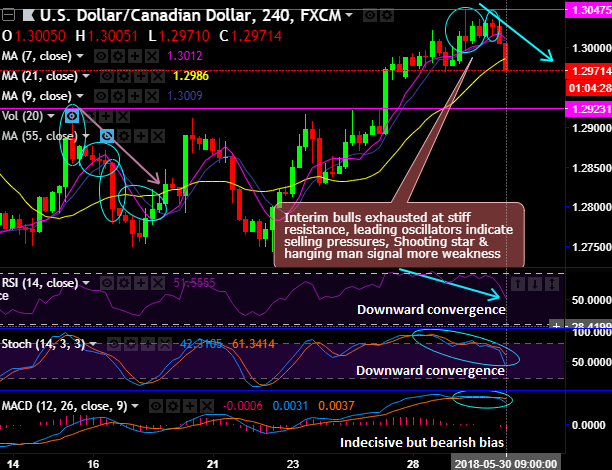

Shooting star has occurred at 1.3009 and the hanging man at 1.3026 levels on USDCAD’s daily chart. As a result, the price tumbles below DMAs with bearish MACD crossovers.

The pair forms hammer pattern at 1.2463 that has evidenced the upswings, on the contrary, back-to-back shooting star and hanging man at 1.2895 and 1.2842 on weekly plotting that hampers previous consolidation phase and bears have resumed in the major declining trend.

For now, despite monthly chart portrays upswings, the current price is hovering 7EMAs, while both leading oscillators on this timeframe have been indecisive but indicates faded strength and lagging indicators signify the bearish trend clarity.

Well, let’s not isolate this analysis, to substantiate this bearish stance, both leading oscillators (RSI and stochastic oscillators on daily terms) converge downwards constantly to the ongoing price dips that signal the intensified momentum and strength the prevailing bearish sentiments.

Consequently, the above-mentioned bearish patterns have more imminent to counter the ongoing upswings for the month at any time.

Contemplating above technical rationale, at spot reference: 1.2965 levels, it is wise to snap deceptive rallies to deploy tunnel spread binary options strategy with upper strikes at 1.2986 and lower strikes at 1.2923.

Alternatively, go short in futures contracts of mid-month tenors with a view to mitigating downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above -56 levels (which is bearish), and CAD at 15 (neutral) while articulating (at 12:25 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate