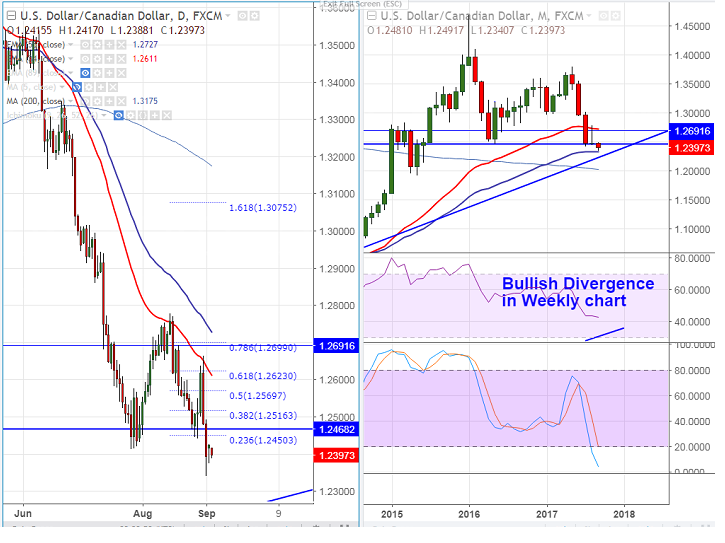

- USD/CAD has formed a minor bottom around 1.23405 and jumped slightly from that level. The pair has jumped till 1.24261 and is currently trading around 1.23965.

- US crude oil shown a minor jump from low of $46.56 till $47.59 at the time of writing on returning refineries after closure due to Hurricane Harvey. The upside is expected to be limited as current infrastructure of U.S crude production has actually made weather events like Hurricane less bullish than before.

- The pair has taken support near monthly 55- EMA and any further bearish continuation can be seen only below that level. The major near term support is around 1.23200 and nay break below 1.2200 (trend line support)/1.2000.

- The near term resistance is around 1.2450 (23.6% fibo) and any break above will confirm minor bullishness, a jump till 1.2502 (daily Tenkan-Sen)/1.2600/1.26625.

It is good to buy on dips around 1.2395-1.2400 with SL around 1.2325 for the TP of 1.2600/1.2660.