Although the Fed will be sensitive to developments in Europe, it would be too early in our view to call for a delayed lift-off on the back of Greece. The streets continue to believe September rate hike driven by better activity data and further evidence of labour market tightness.

The Chicago PMI is projected to rise from 46.2 to 52 which is constant with a bottoming in manufacturing activity evident in most other regions.

Consumer confidence is likely to climb from 95.4 to 100 which would mark the strongest level since March.

On the other hand, technical glimpse suggested that uptrend for USD/CAD remains intact as oscilating indicators moving in convergence with rising price. RSI (14) is currently moving at 49.3987, while slow stochastic has not been showing any overbought stress.

More notable point has been, the volumes on intraday sessions are not confirming on price plunging but it does on rising prices. This should alert bulls are in complete control over bears as bullish price sentiments are robust.

However, fresh shorts for intraday speculation can be sighted at 1.2393 levels for 20-25 pips with keeping a strict stop loss at 1.2402 levels.

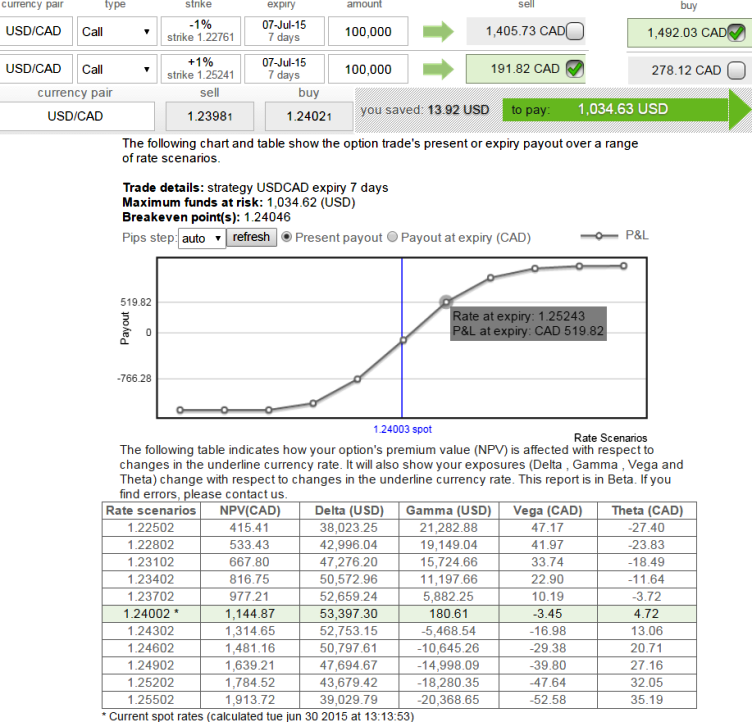

We also advise buying 7D (1%) In-The-Money 0.72 delta calls and sell 7D (1%) Out-Of-The-Money calls with positive theta values.

FxWirePro: USD/CAD binary puts may yield 20-25 pips; but call spreads on hedging front

Tuesday, June 30, 2015 7:49 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?