Yesterday, WTI crude prices have edged higher above $70 mark, as API data showed higher-than-expected 9.2 million barrel drop in the US crude stockpiles in the week to June 22 to 421.4 million barrels. The energy prices sustained above $70 levels and dragged the rallies today above $71 areas on US-Iran tensions.

We see an increased risk that a broad consolidation for Crude can develop into Q3 after hitting our medium-term targets as the US authorities expect every country to cut all oil imports from Iran to zero by Nov. 4 or risk sanctions, a U.S. official said.

Thereby, it seems that Trump’s administration is showing less patience. The official stressed that companies based in China and India, two of the largest buyers of Iranian oil, “will be subject to the same sanctions that everybody else is” if they continue with the purchases.

Moreover, technically we note that WTI confirmed a bearish reversal month with the May close below the April close. WTI sees important support at the 61-59/bbl area; Brent leans a bit more bullish, but risks are increasing as the 74-72/bbl area will define whether the uptrend shifts into a consolidation phase.

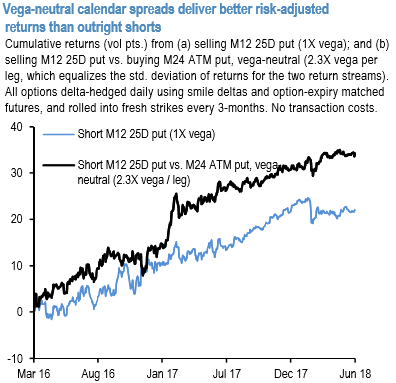

We reiterate focus now on EIA crude stockpiles data announcement which due in the US trading sessions for further impetus and we run you through the most thrifty expression of option structure that takes advantage of the two distortions is a short Jun'19 OTM 30D-35D strike (strike $70/bbl) put vs long Jun'20 ATMF straddle (strike $69.25/bbl) vega-neutral calendar spread (all legs delta-hedged, notional ratio 150 lots of the put vs 50 lots/leg of the straddle).

The net structure is theta-earning by construction, but with the cover of a vega hedge behind the short leg that dramatically improves the risk-reward of naked vol selling.

The above chart illustrates return streams from an outright M12 put and the same put hedged vega-neutrally with a M24 ATM option: the improvement in risk-adjusted returns is palpable, with Sharpe ratios rising from 1.0 to 1.6, and average annual return /max drawdown ratio jumping from 1.4 to 2.4 over the sample period (not inclusive of transaction costs). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts