We all know the saying “one swallow does not make summer”. Referring to yesterday’s consumer price data from the US and the market reaction it caused the story goes as follows:

Consumer prices in the US increased 1.9 pct year-on-year in August of 2017, above 1.7 pct in July and market expectations of 1.8 pct. It is the highest reading in three months, due to rising shelter and gasoline cost as Hurricane Harvey shut down refineries along the Gulf coast. The monthly rate went up to 0.4 pct, the highest since January and above forecasts of 0.3 pct.

While this week’s unemployment claims have also surprised, actual 284K versus consensus 303K and previous 298K. But the US unemployment rate unexpectedly rose to 4.4 pct in August 2017 from 4.3 pct in the previous month and above market consensus of 4.3 pct.

Monthly data like that are very likely to call the Fed into action and lead to much faster rate hikes than the market has been able to imagine for months. In that case, a considerable amount of USD strength would then be a correct forecast.

Nevertheless, the August data was not the continuation of months and months of solid inflation data, if anything they were the start. But of course, it is difficult to imagine a summer without having seen any swallows first. No summer without swallows means: to dismiss the August data as a spike would be careless.

The fact that the market has not corrected its rate expectations (at present only just above one step has been priced in until end of year 2018) notably following the publication of the August data not only depends on the uncertainty about the future development of inflation. A rise in inflation is only a necessary condition for higher Fed interest rates. The sufficient condition is that the Fed will react accordingly to increasing price pressure. That means for the future development of the USD: If inflation continues to rise USD will nonetheless have to work hard for additional strength.

A rise in inflation is only a necessary condition for higher Fed interest rates. The sufficient condition is that the Fed will react accordingly to increasing price pressure. That means for the future development of the USD: If inflation continues to rise USD will nonetheless have to work hard for additional strength.

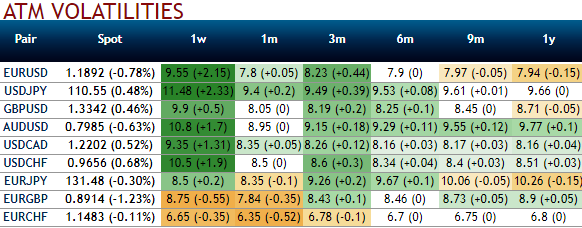

Please be noted that the hedging activities of USD has been mounting higher, IVs have been progressively rising higher for all dollar crosses. For 1w-1m tenors, EURUSD has been a bet for bearish hedging, while the sell-off in the cable skew is exaggerated compared to ATM volatility since the risk remains asymmetric on the downside, the tail risk is mispriced. USDJPY risk reversals indicate the hedging sentiments have shifted slightly into the upside risks. AUDUSD and USDCAD have been bullish neutral and USDCHF evidences the bearish neutral sentiments.

Overall, the geopolitical risk has intensified but with limited FX market impact. Stress indicators from FX markets are at or lower than average, while growth divergences have been the more meaningful driver of returns.

The US continues to lag the growth upgrade cycle, prompting yet another 2% downgrade to USD TWI. FX forecast revisions in the past month are dominated by EM with nearly 60% of the universe upgraded led by Asia.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 77 (bullish) at 07:36 GMT ahead. For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate