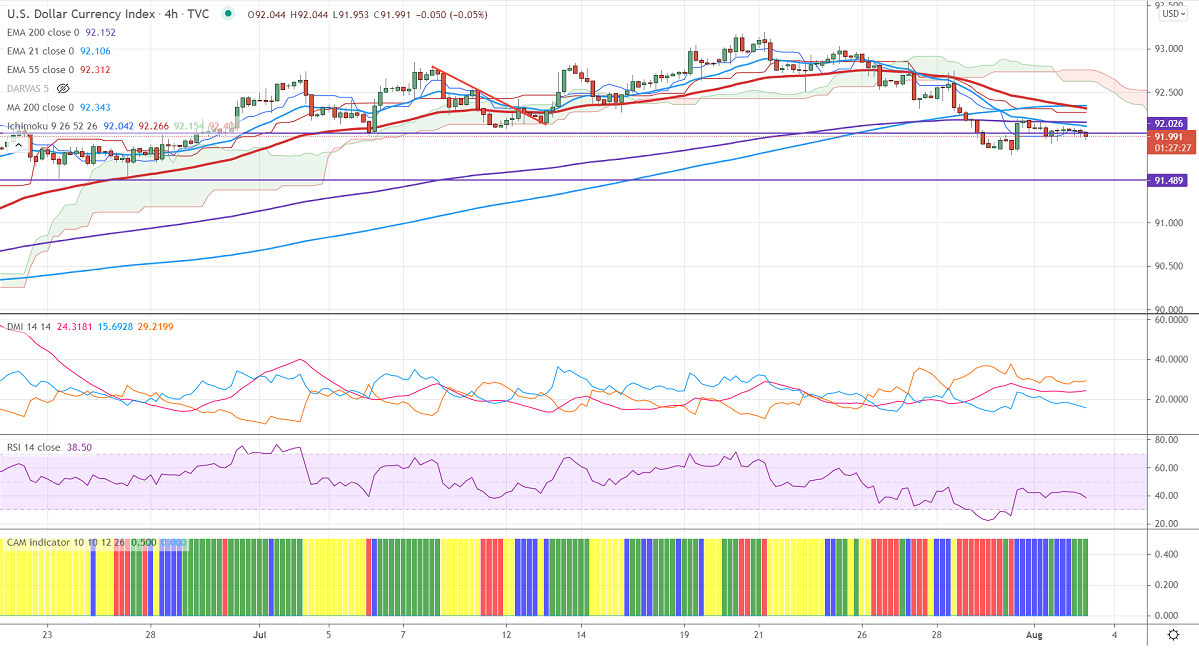

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 92.04

Kijun-Sen- 92.26

Previous week low- 91.78

DXY is trading weak for a second consecutive week on board-based US dollar selling. The dovish comments from Fed and weak US economic data are dragging the US dollar down. The decline in US bond yields also putting pressure on the US dollar index The US ISM for July came at 59.50 below the estimate of 60.4.

Technically, near-term support is at 91.60, and any break below targets 91.35/91/90. Significant trend continuation only below 89.50.

On the higher side, immediate resistance stands around 92.20, and the indicative break above will take the index to 92.50/93/93.20.

It is good to sell on rallies around 92.25-30 with SL around 93 for the TP of 90.