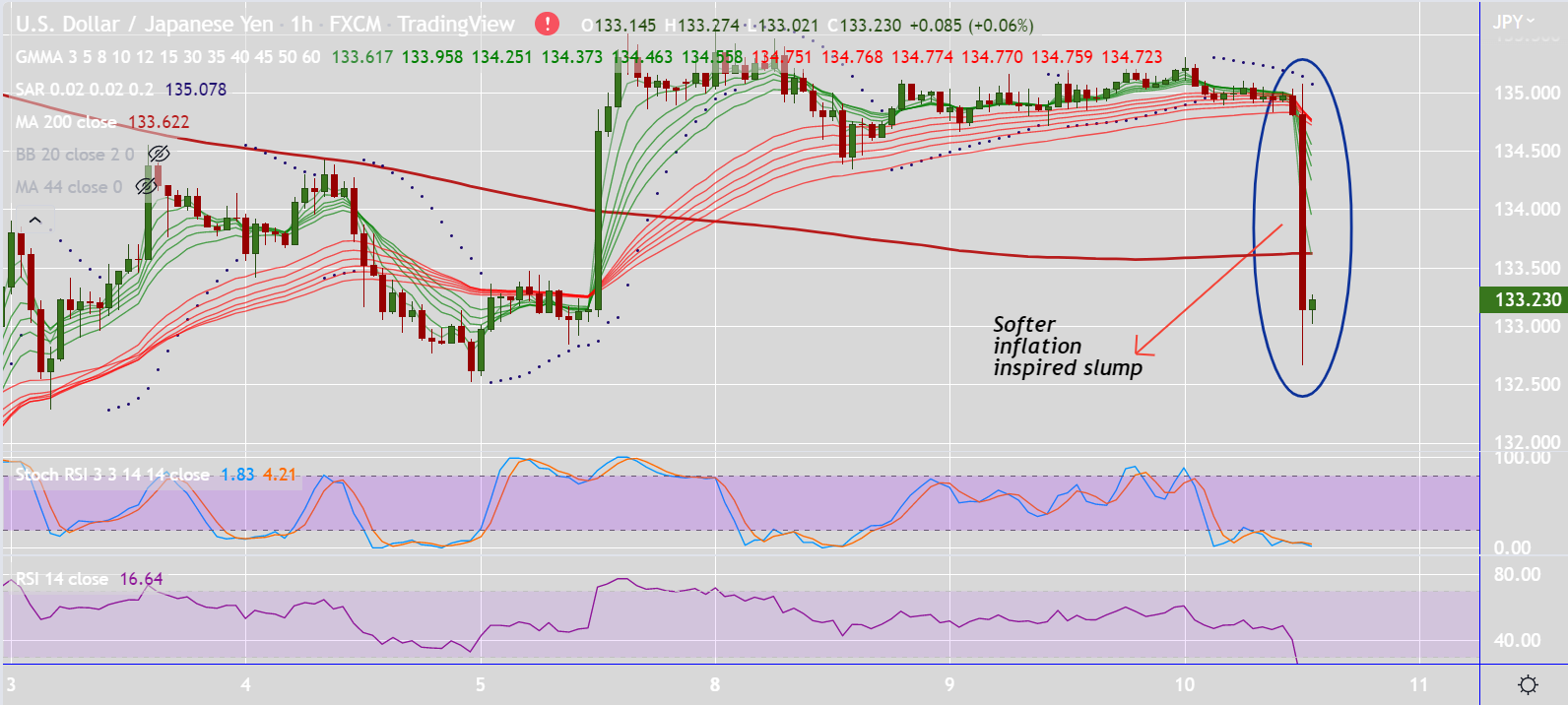

Chart - Courtesy Trading View

Data released by the Bureau of Labour Statistics earlier on Wednesday showed that the headline US CPI remained flat in July against the 0.2% rise anticipated.

The yearly rate decelerated to 8.5% during the reported month, also missing estimates pointing to a fall to 8.7% from the 9.1% in June.

Further, core inflation came in at 0.3% MoM and held steady at a 5.9% YoY rate vs 0.5% and 6.1% expected, respectively.

A weaker US CPI report pushed back expectations for a larger Fed rate hike and weighed on the USD.

USD/JPY plunged back into the daily cloud, hit weekly low at 132.66 before paring some losses to trade at 133.25 at around 13:12 GMT.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran