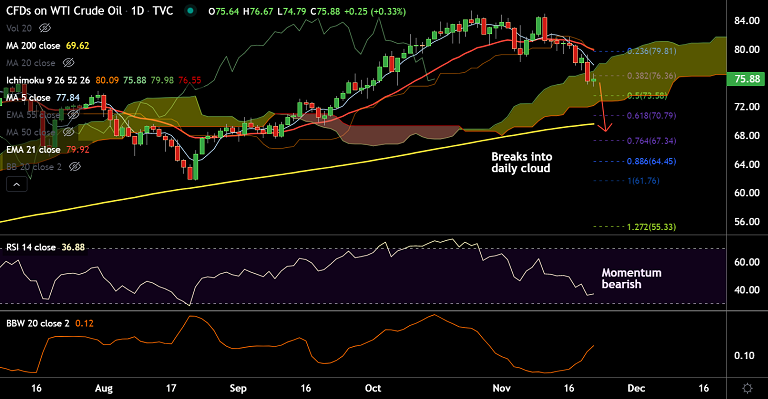

Chart - Courtesy Trading View

WTI recovers a part of Friday’s sell-off, finds strong support at 21-week EMA at 74.86.

European covid lockdowns and a potential release of oil reserves by major global economies, including the US, China and Japan led to a steep sell-off on Friday.

Price action broke into the daily cloud and closed 4.07% lower on the day on Friday, slightly above session lows at 75.12.

US dollar dynamics likely to influence price action along with covid updates amid a data-sparse economic calendar on Monday.

Technical indicators are poised for further downside. Momentum is bearish, volatility is high.

The pair is holding support at 21-week EMA at 74.86, break below will plummet prices. Next major bear target lies at 200-DMA at 69.62.