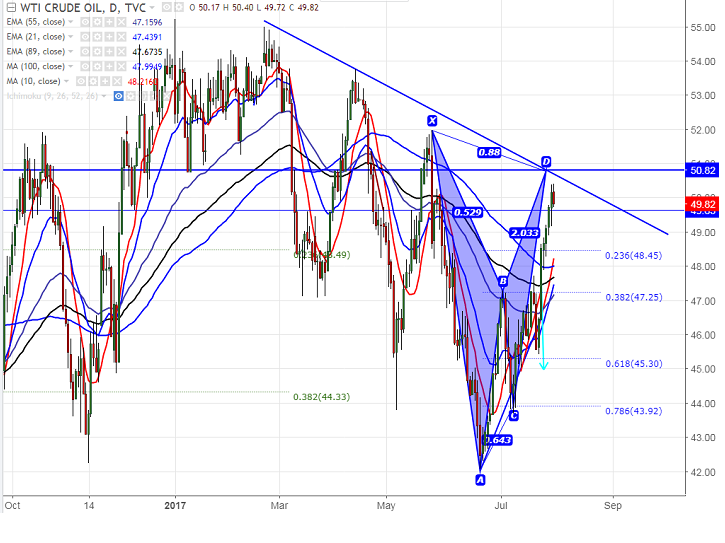

- Harmonic Pattern formed - Bearish Gartley

- Potential Reversal Zone (PRZ)- $51.97

- US Oil has formed a major bottom at $42.08 on Jun 21st 2017 and jumped till $50.38 yesterday. WTI crude was trading higher for the past one month on account on supply tightening.

- On the lower side, near term support is at $49.16 and any break below will drag the commodity down till $48.45 (23.6% retracement of $42.08 and $50.38)/$47.20 (21- day EMA).

- The near term resistance is around $50.85 and any break above will take the commodity till $51.50/$51.97. Any short term bullish continuation can be seen above $51.97.

It is good to sell on rallies around $50.65 with SL around $51.97 for the TP of $48.55/$47.40.