- US Oil has fallen till $47.95 on Friday and shown a minor recovery from that level till $48.95. It is currently trading around $48.60.

- The decline in the crude oil prices was mainly due to increase in the supply and decline in demand. Chinese refineries processed 10.71 million barrels per day in July down around 500,000 bpd. The increase in U.S drilling activity could deepen global supply.

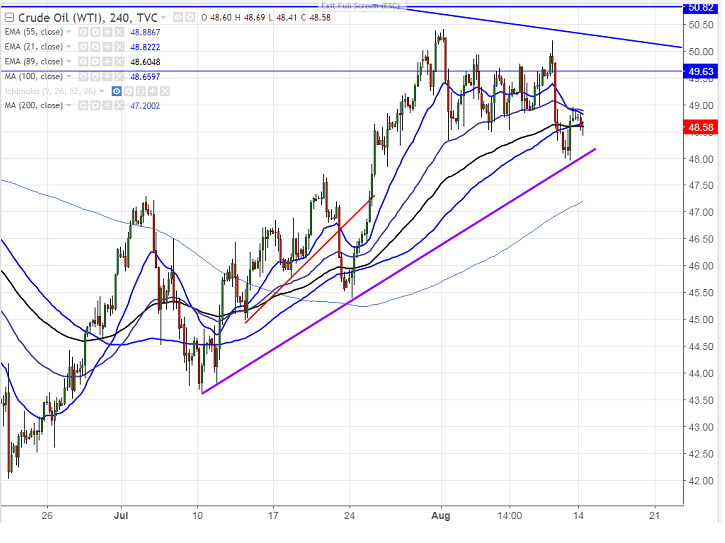

- The downside in the US oil is capped by trend line support and any break below $47.84 confirms bearish continuation and decline till $47.18 (200- 4H MA)/$46.

- On the higher side, near term resistance is around $48.95 (89- 4H MA) and any break above will take the oil till $50/$50.20. It should break above $50.40 for further direction.

It is good to buy on dips around $48.25-$48.30 with SL around $47.75 for the TP of $49/$50.20.