Throughout our previous articles, we suggested to our readers that the supply/demand fundamentals are in place for a large-scale price recovery in natural gas and the only hindrance to that remain the very high level of inventories. We even called on our traders to go long in natural gas at $2.6 per MMBtu with targets around $3.1, $3.7, $4.3 and $5.2 per MMBtu. However, as the winter in North America turned out to be milder than required to reduce the record high inventory, the price of natural gas hit a wall above $3.7 area. The decline in inventory has been in line with its 5-year average, certainly not sufficient.

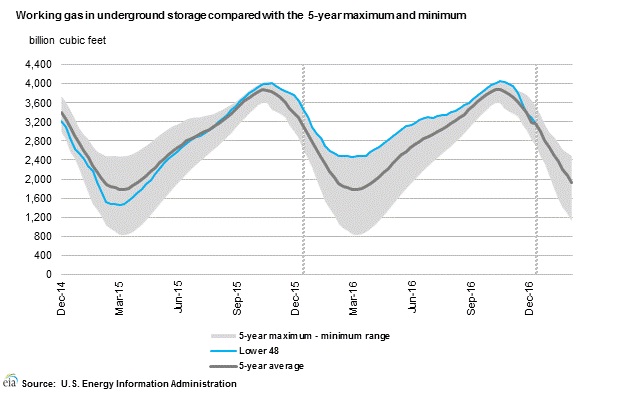

- According to latest numbers, working gas in the underground storage remains at 2.798 trillion cubic feet. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly draws in inventory and that clearly shows that we are past the peaks and from now on the inventory draws would slow down.

- Last week the inventory draw was 119 billion cubic feet and this week draw is expected at 88 billion cubic feet.

- EIA will release the inventory report at 15:30 GMT.

Natural gas is currently trading at $3.13 per MMBtu, with a clear downside bias. We expect the natural gas to reach $2.7 per MMBtu in the near term.