Natural gas is currently trading at $2.88 per MMBtu. We expect the gas price to decline towards $2.52 per MMBtu.

Key factors at play in natural gas market –

- Russia and the United States are set to fight for market share in Asia and in Europe.

- EIA reports that the US is set to become a net exporter of natural gas in 2017.

- Japan is in focus of producers as many long-term contracts are set to expire at the end of the decade. Japan is set to begin importing US LNG this year. Japan’s Kansai energy will import 1.2 million tons of US LNG for next 20 years.

- Large Natural gas producers in the United States continue to expand production per rig.

- Saudi led Gulf group has modified demands on Qatar to six broad principles.

- Speaking at Poland, US President Donald Trump said that the United States is planning to become an energy exporting country and called on Poland and other European nations to diversify its energy resources by taking advantage of the US energy boom.

- US preparing to become major natural gas exporter to the EU and Asia.

- Qatar announced that it plans to increase output by 30 percent, which could be trouble for the US as Qatar is a low-cost producer.

- The United States remains the largest petroleum and natural gas producers in the world.

Now, for the inventory,

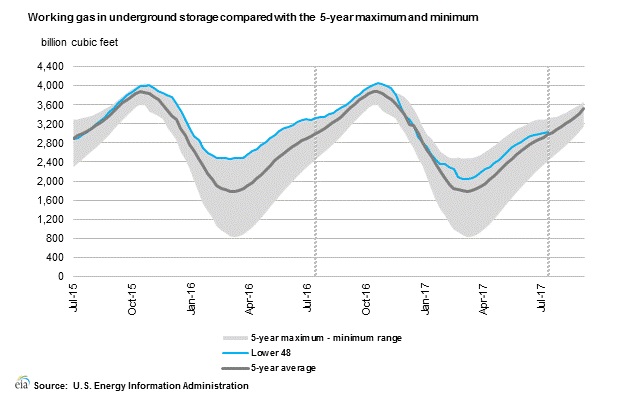

According to latest numbers, working gas in the underground storage remains at 3.038 trillion cubic feet. Stocks were 275 Billion cubic feet less than last year at this time and 61 Billion cubic feet above the five-year average. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory increased by 28 billion cubic feet against an expectation of 38 billion cubic feet. Today 47 billion cubic feet increase expected.

- EIA will release the inventory report at 14:30 GMT.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX