The production has declined over the course of 2016, but natural gas inventory had reached a record high of 4 trillion cubic feet in the same year, thanks to previous two week winters, which depleted less stock. This year, the winter in the United States was quite chilling but not sufficient to draw down this record inventory significantly. Hence, we had to retrace back from our long call, though two of our targets were reached ($3.1 per MMBtu and $3.7 per MMBtu). We had suspected the gas price to reach as high as $4.3 and $5.2 per MMBtu. While we maintain our bullish outlook over the longer horizon, we forecasted fallout in the shorter term.

Based on our view we called on our readers to short call to sell natural gas at $3.14, which has already reached two of the targets at $2.7 per MMBtu and $2.5 per MMBtu area.

Keeping in mind based on our model that natural gas might reach as low as $2 per MMBtu (not our base case) we extended the target to $2.3 with a warning that it might retrace to as high as $2.9 per MMBtu, where we suggested to go fresh shorts.

However, the recent passed away snow storm has changed the outlook and natural gas defied our expectations and reached as high as $3.2 per MMBtu. It is now looking increasingly likely that N-gas might have resumed the long term trend by forming a key bottom around $2.5 area. In such a case our bullish target is again activated. We are still monitoring closely and would soon have an update for our readers. Now, for the inventory,

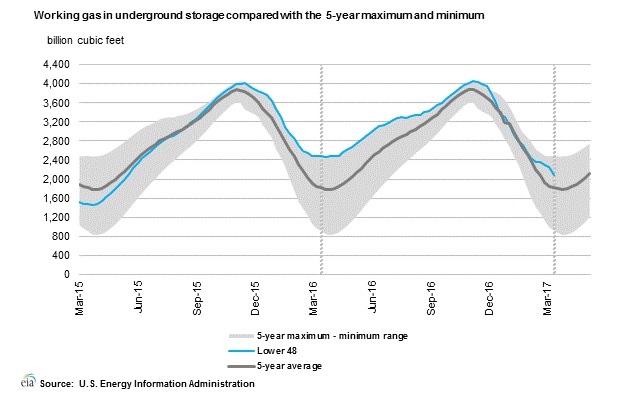

According to latest numbers, working gas in the underground storage remains at 2.092 trillion cubic feet. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly draws in inventory.

- Last week, the inventory draw was 150 billion cubic feet. Today another 42 billion cubic feet draw is expected.

- EIA will release the inventory report at 14:30 GMT.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022