Natural gas is currently trading at $2.91 per MMBtu.

Key factors at play in the natural gas market –

- Natural gas likely to reach towards $3-$3.1 area before sellers emerge again

- Natural gas is looking to recover grounds, after finding support around $2.5 area once more.

- U.S. exit from Iran nuclear agreement complicates the future of vast natural gas reserves in Iran.

- NATO sanctions on Russia might disrupt its gas supplies to Europe.

- Russia says world’s biggest pipeline for natural gas connecting China and Russia is almost complete.

- With geopolitical tensions rising between Russia and the United Kingdom and other European nations, the U.S. looking to fill in the shoes of Russia in terms of gas supply to the region.

- With natural gas turning into a buyers’ market, big importers like Japan are renegotiating long-term contracts with a resale clause attached.

- Russia and the United States are set to fight for market share in Asia and in Europe. US preparing to become major natural gas exporter to the EU and Asia.

- Australia looking to beat Qatar to become world’s largest Ngas supplier.

- Large Natural gas producers in the United States continue to expand production per rig. US exports are increasing significantly.

- The United States remains the largest petroleum and natural gas producers in the world.

Now, for the inventory,

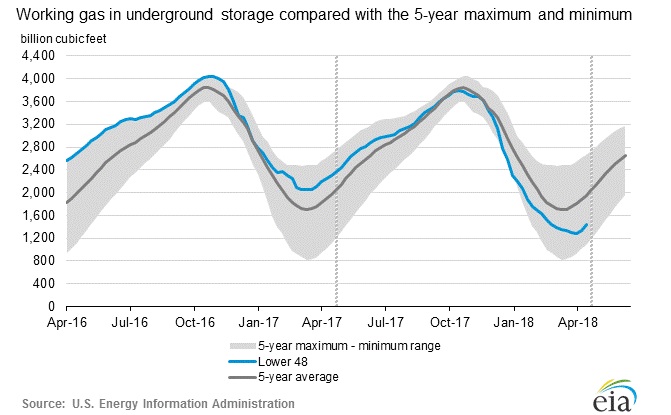

According to the latest numbers, working gas in the underground storage remains at 1.538 trillion cubic feet (Tcf). The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory rose by 106 billion cubic feet against an expectation of 105 billion cubic feet increase. Today 92 billion cubic feet build expected.

- EIA will release the inventory report at 14:30 GMT.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest